VW e-Golf shines, but Leaf #1

After a slip in the previous

month, in October the European passenger plug-in market resumed the growth

path (+24% YoY), by registering some 32,300 registrations, pulling the

Year-to-date count to over 300,000 deliveries (+34%), while the 2018 market

share grew to 2.3%, thanks to a 2.9% share in October.

But growth wasn’t the same on

the two sides of the isle, on the BEV side, sales (or should I say, deliveries?)

are stepping up (+63%), allowing them to grow their share by +1% regarding the

total year breakdown (49% BEV, 51% PHEV), so all-electrics are on track to win

the upper hand over PHEVs this year.

On the other hand, PHEVs are

still feeling the sting of the introduction of the WLTP standard in the

beginning of September, having seen sales decrease by 6% regarding the same

month last year, with several models (Mercedes PHEVs, VW Group PHEVs…)

effectively ending their careers due to the new regulations.

But the PHEV sales drop wasn’t

equal across the category, as some brands (BMW, Mitsubishi, Volvo…) did their

homework and weren’t affected by the new rules, leading to some brilliant

performances in those particular brands, like the #3 Mitsubishi Outlander PHEV.

In October the top spots

didn’t had major surprises, with the only one being the VW e-Golf performance,

with the brand PHEV deliveries falling over a cliff, Volkswagen was forced to finally make way for volume

production of its e-Golf BEV, with the German hatchback hitting a new

deliveries record, with 2,458 units. A sign of times to come?

Looking at the Monthly Models Ranking:

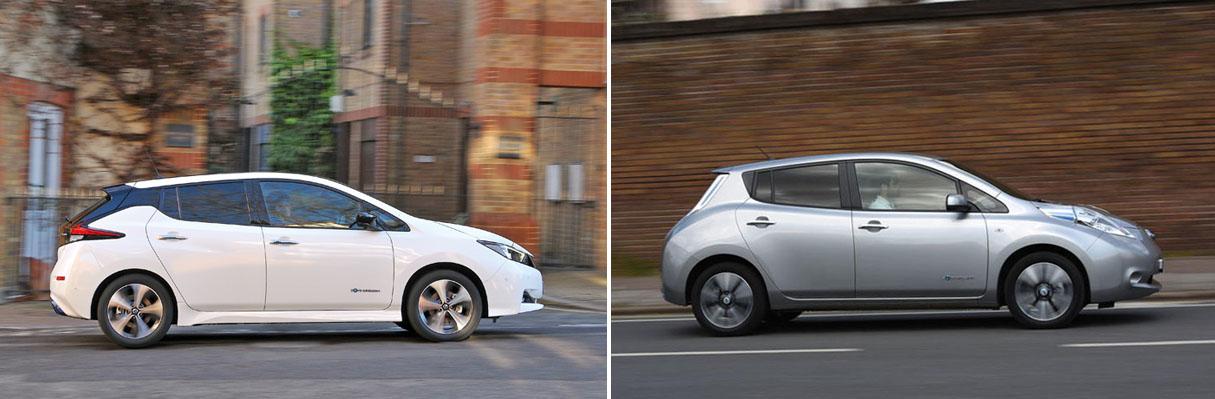

#1 Nissan Leaf – Europe’s Best Selling PEV

model continues to expand its sales, by registering 4,785 units in October (+285% YoY), its best result since March, and

with the orders list still to be satisfied in a number of countries, expect the

Leaf to continue to be the default #1 throughout the year. But back at last

month performance, with the main market being by far Norway (1,292 deliveries),

the Japanese hatchback hit three-digit performances in 12(!) other countries, besides

the usual suspects (France, Netherlands, Germany, UK…) the BEV also shined in

countries like Denmark, Hungary or even the PHEV-loving Belgium.

#2 Renault Zoe – The October 4,061 deliveries meant a 87% growth YoY

for the French hatchback and its best score since last March, with deliveries

expected to continue at this level until the revised model arrives next year.

Anyways, regarding individual market performances, the domestic market did the

usual heavy lifting, by registering 1,745 units (+125% YoY), with other significant

numbers coming from Germany (609 units, Year Best), Norway (411, YB), and also Sweden

(299 units, fourth(!) consecutive record), where the Zoe seems to be a hot item

right now.

#3 Mitsubishi Outlander PHEV – Europe’s

favorite family/towing/winter plugin had a recent specs update, and it shows,

with the Japanese SUV securing yet another Best-Selling PHEV of the Month award

and a podium presence in October, thanks to 2,771 registrations, up 74%, being the nameplate highest result

since March ‘16. The plug-in SUV will continue to offer its unique mix of “affordable”

space, AWD and utility, with the added bonus of a larger electric range (28

mi/45 kms real world range) and more power (+15 hp) at hand, keeping it popular

in markets like the UK, Norway or Sweden. Going forward, with the end of the

PHEV incentives in the UK, a market that represents one third of sales, it will

be interesting to see where Mitsubishi will find other markets to compensate

the UK losses. Will this mean an open race for the PHEV title next year? I

mean, the Outlander has been winning hands down every plugin hybrid trophy

since 2013…

#4 VW e-Golf – It seems the German

hatchback is improving from its not-enough-batteries

disease, just while VW PHEVs are tanking (a coincidence?), allowing it a Top 5

presence, thanks to a record 2,458

deliveries. Looking at individual countries, Norway (978 units, year best),

and Germany (784 units, new record) were major contributors, with The

Netherlands (238) also helping to the tally. Looking ahead, expect deliveries

to continue strong in the next few months (I mean, with PHEVs offline, they

don’t have anything else to make, right?), until VW finally decides to place it

in Sunset-mode, as it prepares the ID/Neo launch.

#5 BMW i3 – The German Hot Hatch sales

increased (+46% YoY) in October, with 2,289

units being delivered, and with the Leipzig factory growing output in order

to satisfy the increased demand for the new 42kWh version, the BMW EV is set to

continue growing throughout 2019. Looking at last month individual countries,

Norway was the largest market for the BMW hot hatch, with 525 registrations,

with Germany (426 units, 306 of them BEV) following it.

|

| Finally living up to its full potential? |

BEVs on the rise

Looking at the 2018 ranking, the top positions remained stable, in fact we have to go to #8 to see

position changes, with the Volvo XC60 PHEV (1,573 units, new PB), BMW 225xe AT

and BMW 530e profiting from the expected off month (first-month-of-quarter…) of

the Tesla Model X, to surpass it.

Elsewhere, another

model from the BMW Group continued climbing positions, with the Mini Countryman

PHEV reaching #14, while two BEVs are rising in the second half of the table,

with the Hyundai Ioniq Electric jumping 2 positions to #15, thanks to a record

1,035 deliveries, while the Smart Fortwo ED is now #17, becoming the

Best-Selling plugin from the Daimler Group…

Outside the Top

20, the big news was the Jaguar i-Pace crossing the 1,000 deliveries in one

month (1,163), expect the British SUV to continue ramping up production, in

order to satisfy a thousands long order list in The Netherlands and elsewhere.

Looking at the manufacturers

ranking, last year winner BMW (16%, down 1%) is in the lead, while the

runner-up Volkswagen (13%), is watching the #3 Nissan (12%, up 1%) with a close

eye, with Renault (9%) in a distant Fourth, ahead of Tesla and Volvo, both with

7%.