Open the Gates! (23% share!)

Tuesday, January 26, 2021

Europe December 2020

Thursday, January 21, 2021

China December 2020

9.4% share in (another) Record Month

If the overall Chinese market ended the year on a positive note (+12% YoY), plugins ended with a record month, growing by 50% YoY in in the last month of the year, to a record 224,000 units, and this time it were PHEVs that grew faster (+108%), than BEVs (+42%), but despite this recent uptick from plugin hybrids, BEVs ended owning 80% of the market, which, incidentally, was the same score of 2019, so it seems plugin hybrids have found their corner of the market, especially in higher end models.

Last month, plugin share reached a record 9.4% (7% BEV), pulling the 2020 share to 6.3% (5.1% BEV), almost one percent increase over the 2019 result of 5.5%, and the same result the market had at the time of the last subsidy change, in the summer of 2019, so one can say that the Chinese EV market took 18 months to recover from impact of the subsidy change.

But looking at the bright side, the only way is up, with only minor subsidy changes happening in the foreseeable future, next year we should see the market reach a few months with two digit shares, preparing the disruption to finally set in by 2022...In the largest automotive market in the World.

And once we get to that point, then it's game over for ICE.

Looking at December Best Sellers, we have 3 City EVs, confirming the return of small EVs to the spotlight, with the Wuling EV keeping the Best Seller status.

Here’s December Top 5 Best Selling models individual performance:

#1 – Wuling HongGuang Mini EV

A big name for a small car, the Wuling EV scored 33,489 units last month, its 6th record score in a row, but the difference regarding previous months wasn't significant, so it seems the production ramp up (or is it demand?) has already peaked, but expect the tiny four-seater to continue in the podium positions throughout 2021, as it is one of the cheapest EVs on the market ($4,200!!!), and yet, it’s not that bad, as the SAIC-GM-Wuling joint-venture model can seat 4 people in car that is a tad larger (2,917 mm / 114.8 in) than a Smart Fortwo EV. At this price level, the Wuling EV is a disruptive force in urban mobility, not only against 4-wheeled private transportation, but also against 2 and 3-wheelers. This EV is becoming a game changer in China, and should do the same elsewhere, if (when?) it manages to expand to overseas markets.

#2 – Tesla Model 3

The poster child for electric mobility hit a record 23,804 units last month, which was somewhat less than expected, but then again, the shadow of its younger sibling Model Y, set to land in January, could be the reason for this. Looking at next year sales performance, expect it to remain more or less on the current numbers, because the bulk of growth in 2021 should come from the new MiC Model Y.

#3 – Great Wall ORA Black Cat (R1)

Probably inspired by Deng Xiaoping famous quote: "It doesn't matter wether a cat is black or white, as long as it catched mice", Great Wall decided to create a Cat Pack, transforming its tiny R1 Smart-lookalike into the Black Cat, launching the R2 model (think Scion XB/Toyota Urban Cruiser kind of vehicle) as the White Cat, and to lead the Pack, Great Wall has just successfully launched (2,016 in its landing month) the Good Cat, a chunky (and funky) compact hatchback (VW Golf sized) that kinda looks like a Porsche 356 in the front, a Toyota from the side, and the back...Well, it’s its own thing. But enough of the Good Cat, we will have plenty of time to talk about it in 2021, we are here to talk about the Black Cat, that delivered 10,010 units in December, it's 3nd record score in a row, creating great prospects for the Cat Pack in 2021

#4 – BYD Han EV

BYD's flagship model continues to grow, having registered 9,007 units in December, its 5th record performance in a row, so it looks the production ramp up is still developing. One of the most competitive domestic EVs on the market, the flagship BYD is becoming a regular in this Top 5, thanks to competitive pricing, it's the size of a Model S, and yet it costs only $32,800, less than the cheaper Model 3. But price doesn't tell the whole story, with a cutting edge 77 kWh LFP battery allowing it to reach 605 km (376 miles) NEDC range (think 400 km / 250 miles in real world), the Han EV is a whole package, with good looks, competitive specs and features, with the killer prices being just the icing on the cake. Oh, and if we were to add the 3,082 units of the PHEV version, then the Han would have been 3rd, with 11,483 units, not bad for a flagship model, right?

#5 – SAIC Baojun E-Series

Compared with the bare basics Wuling EV, the Baojun E-Series (E100/200/300) are the SGMW more hip and upmarket city models, with demand hitting record levels, with 8,992 units being delivered in December. The access to the current subsidy, added to competitive pricing (CNY 93,900 / USD 14,700) before subsidies, makes them appealing for young urban drivers, as well as car-sharing companies and other fleets.

A reference also to the surprise appearance of VW's Tiguan PHEV, in #16, with the compact SUV scoring a record performance of 2,645 units, while the Changan Benni EV profited from the recent restyling to show up in #18, with 2,610 units, the hatchback best score since 2017.

Outside the Top 20, a reference to the #21 Geely Emgrand EV, with 2,503 units, the sedan best performance in 18 months, so Geely's bread and butter model might be headed for a (much needed) revival in 2021, while NIO's flagship, the ES8 full size SUV, had its best score in 2 years, by delivering 2,009 units.

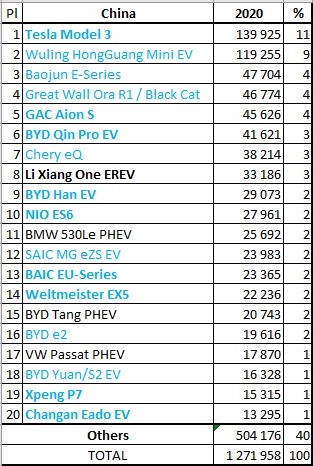

Looking at the 2020 ranking, the Model 3 is the 2020 Best Seller, with a commanding 20,000 units lead over the runner-up, but below it, the #2 Wuling Mini EV is already preparing next year's assault to the Best Selling EV title in China, as the tiny EV won all monthly trophies since September, while in 3rd we have another SGMW model the Baojun E-Series, that surpassed GAC's Aion S in the last stage of the race and secured another medal for the joint-venture.

This highlights the latest trend in China, City EVs are returning to the spotlight, not only with the SGMW EVs, but others are also earning the spotlight, like the Great Wall Ora Black Cat, that ended the year in 4th (it had been #11 in the previous year), the #7 Chery eQ, thus making 4 City EVs in the Top 7. Just counting these four models together, we get a quarter million units, or 20% of the total EV market...

But it weren’t only City EVs rising in the table, BYD had two models rising in the table, with the Tang PHEV climbing to #15, while the Han EV jumped 3 spots, to #9, becoming the 2nd BYD on the Top 10.

XPeng also had reasons to celebrate as the much hyped P7 ended the year in #19, being the 4th local startup model on the table, another significant change regarding 2019, because at that time, there was none (and the Tesla Model 3 was only #8, imagine that...).

Looking at the manufacturers ranking, the Surprise of the Year was the SGMW joint-venture (15%) breaking a 6 year winning streak of BYD (14%, down 1%), thus becoming the 2020 Best Selling manufacturer, with Tesla (11%, down 1%) securing the last place of the podium.

Interestingly, in 2019 SGMW ended with just 5% share and Tesla with 3%...

Below the podium, SAIC (7%, up 1% share) won the 4th spot with some ease, overcoming the #5 GAC, #6 Volkswagen and #7 Greal Wall, each with 5% share.

As for BAIC, 2020 was a true horror movie, falling from 2nd place and 14% share in 2019, to just 2% share this year!

By Automotive Group, the big winner was Shanghai Auto, or SAIC, that thanks to the SGMW joint-venture, where it has a majority stake (50.1%), and its own sales, it had 22% of the market all to itself, a jump from the 12% of 2019, followed by BYD (15%), Tesla (11%) and the VW Group (6%).

Expect these last two to increase their share in 2021, thanks to the Tesla Model Y and VW ID.4 launch.

So, long story short, in 2020, there were three main stories in the Chinese EV market:

1 - The Tesla Model 3 became the Best Selling EV, the first time a foreigner achieves such a feat;

2 - Local startups, lead by NIO, are growing fast, and are already starting to show up on the radar, so their next step is to gain scale fast in order to get to six digit sales numbers per year and thus securing their survival from the big sharks;

3 - City EVs returned to the spotlight, proving that Chinese OEMs are in a unique position to dominate that vehicle category (and future autonomous pods?), and in that context, SAIC was the biggest gainer of the year, managing even to steal Tesla's thunder towards the end of the year (but don't tell that to Wall Street...).

Monday, January 18, 2021

Germany December 2020

27% share! Open the Plugin Gates!

The German automotive market has opened the flood gates to plugin vehicles, with December setting yet another record month, with a little less than 83,000 units, PEVs scored an amazing 27% share (14% BEV) in December, making Germany the largest PEV market outside China, beating even the USA by a wide margin (394k vs 330k)...

In a completely disrupted market, while diesel (-31% YoY) and petrol (-20%) were down in December, all electrified categories were shooting up, with HEVs up 133% YoY, while PHEVs jumped six-fold(!), and BEVs did even better, jumping 7-fold(!!!), with the end of 2020 becoming a stampede into electrified vehicles, we have to the point where, despite tanking Fossil Fuel sales, electrified sales allowed the overall market to actually grow 10% YoY in December!

Now, how much of these events are related to last minute compliance of the EU's CO2 emission rules, it's anyone's guess, but regardless of this, it is proof that regulations do work and when pushed, Legacy OEMs are indeed able to comply.

The supreme irony of this, is that by forcing local OEMs to move fast into electrification in order to comply with the CO2 emission targets, EU politicians might have saved the local automotive industry from a future death at the hands of Tesla and Chinese OEMs...

But leaving political considerations apart, after all this isn't Politico, and back at the German PEV report, the 2020 tally ended at 14% (6.7% BEV), so expect 2021 to continue with the current disruption, with plugin share above 20% for plugins and BEVs hovering above 10%.

Thursday, January 14, 2021

France December 2020

A future star lands in a record market (19% share!)

Speaking of City EVs, it seems this category is the new hot stuff in France, with 3 representatives in the December Top 6, as not only the Dacia Spring EV won the Bronze medal, but the fresh Fiat 500e was 4th, with 1,545 units in only its 2nd month on the market, and the also recent Renault Twingo was 6th, with 1,353 units, a new record for the tiny French EV. And let's not forget the veteran VW e-Up, that scored a record performance in December, with 525 deliveries.

The Climber of the Month was the VW ID.3, that came from below the Top 20 into #9, in the last stage of the 2020 race, which is a good start for the 2021 race, where the German hatchback will try to beat the Tesla Model 3 and become the Best Selling Foreign model in France.

On the second half of the table, we have the Citroen C5 PHEV climbing two spots, to #13, while the #22 VW e-Up was the Best Selling City EV in 2020, a title that the veteran model should have for the last time in its possession, considering the slew of new models (Dacia Spring EV, Fiat 500e, Renault Twingo EV...), all with Top 20 ambitions in 2021.

Tuesday, January 12, 2021

Norway December 2020

Audi e-Tron 2020 Best Seller in 65% PEV market

Pl | Model | Sales |

1 | Tesla Model 3 | 4.232 |

2 | VW ID.3 | 2.303 |

3 | Volvo XC40 EV | 791 |

4 | Nissan Leaf | 692 |

5 | Polestar 2 | 670 |

A step below, we have Mercedes and Tesla, both with 6% share.