Tesla Model 3 new #1 in hot market (16% share!)

The European passenger plugin market continues on the rise, having registered over 227,000 units in March (+169% YoY), placing last month plugin share at 16% share (7.6% BEV), pulling the 2021 PEV share to 15% (6.6% for BEVs alone).

This time growth came from both fields, with BEVs doubling their sales year-on-year, but PHEVs continue surging at a faster pace, having seen their sales jump by 264% YoY last month, confirming plugin hybrids as the major growth source for plugins in the first months of 2021.

With a higher than expected end-of-quarter peak, the Model 3 won its second Best Seller title in a row, confirming its good form this year.

The same can't be said about the remaining 2020 podium bearers, as that year winner Renault Zoe was only 4th in March, while the VW ID.3, Bronze medalist last year, continues to underperform, reaching a low 6th place last month...With VW's hatchback faltering, all eyes are now on the new ID.4 crossover, that had its first real deliveries month in March, ending the stage in #5, already above its slightly older (and shorter) sibling. A sign of things to come?

Looking at March Top 5 Models:

#1 Tesla Model 3 – The sports sedan returned to form, by delivering 24,184 deliveries last month, a larger than expected high tide, allowing it to register 4 times more units than the runner-up Hyundai Kona EV. Regarding March, the Model 3 hade several 4-digit scores, namely in the United Kingdom (6,500 units), France (4,524), Germany (3,699), Norway (2,169), Italy (1,363) and Sweden and Austria, both with 1,192 units each.

#2 Hyundai Kona EV – The Korean crossover is already recovering from the pull forward stunt of the last months of 2020, something that others can't say the same, with the Hyundai EV reaching the runner-up place in February, no doubt thanks to its competitive range vs price ratio, with the distinctive crossover scoring 5,643 deliveries last month. In March, Germany was by far the best market for the Hyundai nameplate, with 3,237 deliveries, followed by the United Kingdom (800 units), France (409) and Norway (349).

#3 Volvo XC40 PHEV - The smallest of Volvo's PHEV lineup is now the the continent's favorite PHEV, as the Swedish carmaker sees their plugin hybrid versions as just another trimline in Europe, facilitating sales, especially of the XC40, that sits at the heart of the hot compact SUV category. In March, the Belgian-built Volvo scored 5,567 registrations, earning its 3rd Best Selling PHEV title in a row. The markets where the Volvo plugin was in high rotation were Sweden (1,192 units), the United Kingdom (900) and Germany (624 units). Without production constraints and currently experiencing strong demand, the compact Volvo is a strong candidate for the 2021 PHEV Best Seller title.

#4 Renault Zoe – The 5,482 deliveries number show that the French hatchback is yet to recover from the last year end peak effort, having seen its registrations drop by in two digits last month, an even more worrying event, when we consider the context of doubling sales in the European BEV market. In any case, the main markets in March were the usual, with Germany (1,692 units) leading, followed by France (1,519), while Italy (721), was a distant 3rd.

#5 Volkswagen ID.4 – Sitting in the vortex of the current hottest trends (Plugins and compact Crossovers/SUVs) much is expected from the new Volkswagen, especially considering that its ID.3 sibling hasn't really set the market on fire...The ID.4 doesn't have much margin for failure, so it was good to see it start its first real deliveries month in 5th, just 500 units behind the runner-up Hyundai Kona EV. With the ID.3 failing to run at the same pace of the Tesla Model 3, now its up for the ID.4 to save VW's honor in Europe. But back at last month performance, the German EV registered 5,104 units, with the biggest market being its homeland Germany, with 872 registrations, followed by Norway, with 856 units, and the United Kingdom (500).

Looking at the remaining March table, besides the disappointing performance of the VW ID.3, the highlights regard several record performances on the table, like the #7 BMW 3-Series PHEV scoring a record 4,957 units, the #10 Peugeot 3008 PHEV hitting a record 4,243 registrations, while the veteran VW e-Up hit a record 4,206 units, an amazing performance for the small EV, that can only be explained by the lower than expected sales of the ID.3, that is forcing the German maker to increase production of the cheaper (and less profitable) e-Up.

Still on the subject of record performances, and highlighting the great moment of Volvo, the XC60 PHEV scored another record score, with 4,189 units, slightly ahead of another record performer, the Peugeot 208 EV (4,098) and the #19 BMW X1 (3,876).

A mention also to the Nissan Leaf, that thanks to heavy discounts of its 62 kWh version, has jumped to 8th last month, with 4,708 units.

Outside the Top 20, a mention to the Toyota RAV4 PHEV, with the Japanese maker continuing to ramp up the deliveries of its RAV4 PHEV model, reaching 2,575 units last month, a new record for the Japanese SUV and the same number of units registered as the Peugeot 2008 EV, with the French crossover apparently still in (slow) production ramp up. The Mini Cooper EV scored a record 3,324 units performance.

Finally, an interesting fact, if we sum all VW Golf cousins PHEV sales together (Seat/Cupra Leon + Skoda Octavia + Audi A3), we get almost 10,000 units, which added to the VW Golf PHEV registrations, we would reach some 14,000 PHEVs on these compact cars alone.

Looking at the 2021 ranking, the main news was the Tesla Model 3 shooting for Number One, with the sports sedan having almost a 20,000 units lead over the #2 Volvo XC40 PHEV.

And with the remaining last year Best Seller competitors underperforming, the Renault Zoe is down 39% YoY, while the all-new VW ID.3 is just 12% above what the then veteran e-Golf had 12 months ago, one can already say that this Second Quarter will be a stroll around the park for the sports sedan, possibly securing enough advantage over the competition to allow it to manage a demand defection to the Tesla Model Y or volume surges in the competition tallies, now being the main favorite to win the 2021 Best Seller title in Europe.

But the Climber of the Month was the Hyundai Kona EV, that jumped 5 spots, to #5, with the Korean crossover now ambitionin a podium seat.

The BMW 330e also had a good month, climbing to 6th, but year-to-date, the BMW midsizer has about a third of the Tesla Model 3 sales, which says a lot about the impossible uphill battle that the future BMW i4 will have to face...

On the second half of the table, the small VW e-Up continues to climb in the ranking, it's now in #13, just one position below another rising model, as the Ford Kuga PHEV (Euro-spec Ford Escape) jumped from #16 to #12 in March.

We had three models returning the table in March, with the most surprising being the Nissan Leaf, up to #16, while the VW Golf PHEV was up to #17 and the Mercedes A250e, last year Best Selling PHEV, jumped to #19.

Unlike the models ranking, where we already have a clear favorite, in the makers ranking, balance is the word, with the 3 top brands separated by just 700 units, as Volkswagen, Mercedes and BMW all have 10% share, with the Wolsburg brand currently on top, but the differences are so small that anything can happen.

Below these three we have the #4 Volvo, with 8%, followed by Tesla (7%), while in tied in 6th, we have Peugeot and Renault, both with 6% share, with the first currently having a 34 units advantaged over its arch-rival.

BEV D-Segment / Midsize category

Tesla's midsize sedan lives in another galaxy, having won a sizeable distance over the competition, and has seen its sales increase 47% over the first quarter of 2020, highlighting the fact that it won't have significant competition in the next few months, as the Tesla Model Y will only land in the second half of the year.

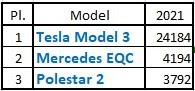

The Mercedes EQC (2,131 units last month) recovered the second spot, having surpassed the Polestar 2 in March, with the Sino-Swede now being some 400 units behind the Mercedes SUV (4,194 vs 3,792).

So far, the only other significant midsize BEV was the Jaguar i-Pace (792 units in March), but the BMW iX3 has finally started to be delivered in volume, with the midsize BMW delivering 566 units last month.

Will we see it surpass the Jaguar in the next couple of months?

BEV E/F-Segment / Full Size category

The e-Tron domination is unquestionable but its seemingly never ending growth seems to have finally stopped, with the Big Audi current 7,642 units representing an 8% sales drop YoY, but despite this, the Audi SUV seems destined to win another category title this year, with Tesla basically giving up on the Model S & X for the first half of the year, what they will recover in the second half of the year, shouldn't be enough to compensate for the drought in the first half, while the #2 model, the Porsche Taycan (1,778 units last month) is too niche to go head to head with the e-Tron in the sales charts.

Regarding the remaining competition, the Mercedes EQV Luxury Van is still in 3rd place, with 431 units, 41 more than the Audi e-Tron GT, but shouldn't be here for long, as the Audi e-Tron GT production ram-up should allow it to reach the podium soon, thus making a 1-2-3 lead for the VW Group.

Tesla Model 3: product

ReplyDeleteTesla Model Y: product

Tesla Model S: vaporware

Tesla Model X: vaporware

Tesla Truck: vaporware

Tesla 2-seat sportscar: vaporware

Tesla Pickup: vaporware

Tesla compact car: vaporware

LMAO. There are more S/X on the road than most of cars on this list. Guess they're all vaporware, too? Of we classify something a car as vaporware simply because the line is being re-tooled, there would be no cars we could not consider vaporware.

Delete3, Y, S, X, original Roadster, Powerwall, Megapack, Solar Roof makes 8 products, with 4 more in the works.

Cool down in your angry against Tesla because if with only "two" products they are able to dominate like that (and able to make you so mad). Now imagine when all these "vaporware products will became products (most of them in the next 6 to 12 months), you will be scarcely desperate, which is not good for you, nor for people around you.

DeleteTake a breath, others brands are coming too in the EV game, Tesla can't do all by its all (and that's fine and desirable), to us to get ride of most of ICE cars in the road at soon as possible.

Tesla is being rewarded fro the fact that they believe in EV, if not sooner than others, at least it risked it all to succeed, and now this risk taking behaviour is paying off greatly, if not amazingly, which is fair.

Between China and Europe that nearly 50,000 units for the Tesla Model 3.

ReplyDeleteCrazy that for the month, Model 3 more sales than the next four cars on the list combined; for the year, it's nearly as much as the next three combined.

DeleteSo much for the ID.3 putting an end to Tesla sales in Europe, as I still see posted everywhere.

Es lo que pasa cuando centras la mayoría de tus trimestrales ventas en 1 solo mes y encima solo tienes 1 modelo a la venta.

DeleteLa realidad es que la cuota de mercado sigue cayendo y cayendo trimestre tras trimestre.

Viva la competencia

They should pass the one millionth delivery this Q2, I think.

DeleteI wouldnt count out VW just yet, the ID3 is not fully avaibale in all markets yet. Looks like April ID4 sales may come in higher than teslas entire Q1 Europe sales. Lots of new models out by other brands over the summer as well so should be an interesting year. All i know is oils had its day.

DeleteExacto, VW solo tiene un modelo a la venta, el ID.3, por eso vende 3 veces menos que Tesla en 3 meses.

DeleteY cada trimestre leyendo las mismas chorradas.

Cuando el model Y se venda más que el ID.3 y el ID.4 juntos seguro que sigues diciendo lo mismo.

Saludos Kike :=)

Other than the VW ones, I think the only other new model that might come anywhere close to Model 3 would be the Ioniq 5 -- but knowing Hyundai, production will likely be way below demand for a long time...

DeleteYou accidentally used March numbers instead of YTD ones for Model 3 in the BEV D-Segment / Midsize category table.

ReplyDeleteimpressive 227.969, 16 % share.

ReplyDeleteeurope + china has 438.486 and global is coasting toward 500.000 mark again.

a phev with 50 km electric range on 500 km total range should be expected to go at least 10% in electricity, failing which the subsidy given to it should be revoked. this will prevent corporate crooks from leasing a phev on company cost and running it on petrol. once they put their vehicle on charge, it will easily do 50% on electricity since most peoples daily commute is less than 100 km round trip.

phev rebate is becoming a hot topic in europe now.

10% electric driving wouldn't nearly justify the large incentives they are getting in many countries, nor the 75% emission reduction assumption for the fleet emissions mandate. However, since few people would bother to charge it only sometimes in order to fulfil the requirement, this might actually work...

DeleteTesla Model 3 scores an impressive 24.184 in a phev heavy market.

ReplyDeleteModel 3 stands is only pev to score 5 digit sales and stand atop the hill like

"Simba the Lion King"

With a 400+ km range, panoramic roof, 60 km/lE (EPA, more in WLTP), availability in RWD/AWD and just $39.000 price tag, its a luxury BEV to buy.

No wonder, it leads in both month and ytd. It has 94% sales with 6% lease and it contrasts with nearly 40% sales/60% lease in other luxury cars in its range.

We don't do dollars. And locally it would be starting from $66k....

DeleteIf the price in my part of Europe would be $39k then I would buy another one for the family just for the sake of it.

You can have the 3 on Spain by 37k after PIVE.

Delete"while the veteran VW e-Up hit a record 4,206 units, an amazing performance for the small EV, that can only be explained by the lower than expected sales of the ID.3, that is forcing the German maker to increase production of the cheaper (and less profitable) e-Up."

ReplyDeleteFrom what I understand all e-Up! deliveries are just fullfilling preorders from months ago (for example in Germany last September they had to close the orders for e-Up! since its production for the next 16 months have been sold out), so low ID.3 sales probably has very little to do with it.

Also when talking about D segment BEVs, shouldn't XC40 BEV be ahead of Jaaaag I-Pace? According to eu-evs.com data, just in the 9 countries it has montly data for it sold 968 units in March/2568 in Q1.

XC40 is Compact, i.e. C segment.

DeleteBy march end, all self-registered VW ID.3 should have been sold and april should see a big increase. Otherwise, VW and the concerned city, state, national governments should launch an investigation into the dealers who are hiding ID.3 under the pillow.

ReplyDeleteIts based on whole new efficient MEB architecture designed for a cost effective models. After spending billions of euros, 1000s of manhours in r&d, training, procurement, production, advertisement and delivery, if the dealers dont sell, its a serious offense.

Otherwise a direct automaker to customer sale of BEVs should be allowed with service to be done by automaker. Its crystal clear that in USA, the dealers are marking up MachE by $5.000 to prevent the sale. So every new automaker like Lucid,

Rivian are going for direct sale.

More than 2 years, 2 months after Chevy Volt production is stopped, still 4 units are for sale.

https://www.autotrader.com/cars-for-sale/new-cars/chevrolet/volt/los-angeles-ca-90001?searchRadius=0

I'm not aware of Europe having any anti-competitive dealership protection laws like the US?... Car makers are only bound by contractual and other relations with their existing franchises AIUI -- they could start selling directly any time they want I believe, if they weren't afraid of backlash from their current channels...

DeleteFunny how close all the various entrants are right now...

ReplyDelete(Except for the Model 3, that is.)

Most likely this year we will see a battle between T3 and ID4.Will be even more fun

DeleteI think the VW T3 is an oldtimer by now? What do you mean by battle between an oldtimer VW bus and electric new "bus" aka ID4? I think the T3 was replaced by the T4 around 1990 or before already....

DeleteTesla Model 3 and VW ID.4

DeleteAnd then compare it with the Manufacturers ranking. One of the reasons why the Model 3 is sofar ahead of everyone else, has to do with the fact that they are effectively a "one car brand" right now, so if you want a new Tesla now, you can choose between a Model 3 and another Model 3.

DeleteThe same isn't true with Volkswagen, or most of the competition here, and i believe part of the reason why the Zoe is suffering this year, has to do with the introduction of the cheaper Twingo EV.

The same can be said about the Peugeot 208 EV, it has internal competition from the 2008 EV, or even the Opel Corsa EV, which is a 208 EV with more conservative clothing.

I don't think many people choose a brand first and a vehicle size/class later?...

DeleteNot to mention that people who want a different Tesla are more likely to wait for Model Y than to buy a Model 3 right now. (Case in point: while Model 3 sales in the US did drop a bit with Model Y becoming available, it's not a huge change. Same with Model S/X years ago. And thus far it doesn't look like Model Y in China has affected Model 3 sales at all...)

Badge-engineered models such as 208/Corsa are a different story of course... But it wouldn't change the situation significantly if you added these up.

None of this is pertinent to the essence of my remark though, which was that -- with the exception of Model 3 (whatever the reasons) -- all models in the table are surprisingly close: which is a very unusual and rather funny situation.

And that's how i like it: Balanced tables, where anything can happen, be it here in the EV world, in sports, etc.

DeleteDon't count the ID.3 just yet... At some point, the overhang from last year's channel stuffing will be over -- possibly soon.

ReplyDelete(Also, rumour has it that they are intentionally stalling until the software is decent enough to finally launch it for real...)

I'd be quite shocked if it doesn't start soaring well above the Leaf for example in the next couple of months.

Consequently, between the ID.3 and ID.4 -- with support from the strong e-Up!, as well as the Golf and Passat PHEVs -- I think it very likely that Volkswagen will (expectedly) leave Mercedes and BMW far behind as the year progresses...

@Jose Pontes: There is 1 pro-EV anonymous and 1 anti-EV anonymous.

ReplyDeletePlease advice the bloggers to pick up some name. May be bun, dog, toy ...

LOL

DeleteThe largest discount EV in...Romania!Please,do a review in April.Very curious

ReplyDeleteTesla massive use of foreign-made parts leads to constant price adjustments due to currency exchange...

ReplyDeleteLOL

The recent US price increases are related to chip shortage and other supply chain tribulations. While exchange rates (such as the strong Yen) can theoretically have an impact on production costs, Tesla uses too few "foreign" parts for it to be significant. Exchange rates mostly affect selling prices for imports of complete cars to Europe etc.

Deletethank you Josè for your great work, you will do OEM Q1 Europe? by chance do you know the Seat Mii and Skoda Citigo data? Ty

ReplyDeleteBoth together are about as much as the e-Up alone.

DeleteHi,Jose.

ReplyDeleteCan I graph the numbers of these sales data and post them on twitter, etc.?

Sure!

DeleteJust mention the source, with link to the website.

Thank you.

DeleteAny chance for manufactuers EV rating, at least quarterly, if not every month?

ReplyDeleteIt's a pointless comparsion, when Tesla has 1 model, while the likes of VAG have several.

Cleantechnica has another numbers than in this site 😕

ReplyDeleteSome of the numbers are estimates; and others can vary depending on how you count (wholesale/retail/registrations; new vs. used; parallel imports...) -- so there will always be some discrepancies.

DeleteShouldn't be a large difference, though?