Tesla Model 3 beats Renault Zoe! (And Peugeot 208 EV beats both of them...)

If the overall automotive market continues suffering from the Covid-related pandemic (-21% in February), plugin sales remained positive, with PHEVs on the rise (up 134%, to 9,097 units, allowing them to have a 52% share among plugins last month, not far from the 56% peak of January, the BEV recovery regarding the previous month is due to a less horrible month from pure EVs, that were down in February by just 11%, a marked improvement from the steep 41% drop of January. Still, the French market is known to be BEV-friendly, so fully electric models will likely recover as the year advances.

Regarding the plugin share, last month it reached 13% (6.3% BEV), keeping the YTD share at 12% (5.8% BEV), and if we were to add the plugless hybrids to the tally (HEV and MHEV), then the electrified share of the French market would hit 31%(!), as plugless hybrids hit an amazing score of 18% in February, true, most of it is due to mild hybrids, but still, this meant that petrol vehicles saw their share being reduced by 5% in February, to 44%, compared to the same month last year, but more shocking is the 9% reduction of the diesel share in only 12 months, with the black fuel now having only 25% of the (once diesel-addicted) French market...

At this pace, diesel will be mort here by 2024...

Looking at last month Best Sellers, a lot is going on in the top spots, first the Peugeot 208 EV had its first two win streak in this market, after winning in January, the Stellantis EV did it again in February, but the biggest surprise comes in 2nd, with the Tesla Model 3 winning Silver, with 1,166 deliveries, its best off-peak score ever in France, which could mean that the sports sedan might be headed for a record performance in March (1,500?), and a possible monthly win in France, which would not only be its first in this market, but also the first time a foreign model would take that honor...

The last place of the podium went for the Peugeot 3008 PHEV, with 1,104 units, thus making two Peugeot's in the podium, but also securing the BEV and PHEV monthly wins, beating the Renault arch rival in both categories...

Speaking of Renault, its Zoe best seller was relegated from the podium, for the first time since 2012(!), ending February in 4th, ahead of the #5 Renault Captur PHEV (that lost the PHEV category to the aforementioned Peugeot 3008 PHEV) and the #6 Renault Twingo EV, that saw its Stellantis rival (Fiat 500e) ending in 7th, so Renault now looks to be surrounded by a Stellantis model assault (with a certain Tesla cowboy helping along) and with little help from their Group companions (there are no Nissan's or Mitsubishi's in the Top 20), it seems Renault is destined to lose its decade-long grip of the French market, and a new cycle is set to start.

Another example of the broad appeal that the Stellantis (looong) lineup has, is that the Conglomerate has 8 models, from 5 different brands, in this Top 20. Impressive, eh?

Elsewhere, a mention to the good score of the Mercedes GLC300e/de, with 412 registrations, while the VW ID.3 showed up in (a still discreet) #14, and the Ford Kuga (euro-spec Escape) PHEV returned to the table in #15, thanks to 302 registrations, its best score since July, so it seems the battery issues are now a thing of the past and the Ford crossover is back on its feet.

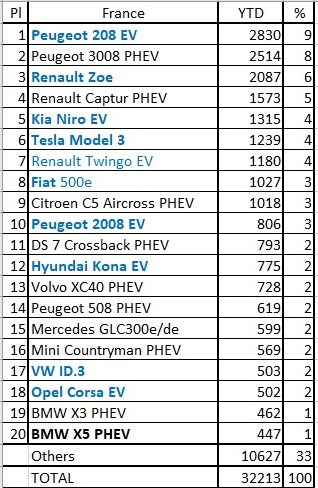

Looking at the 2021 ranking, we have two Peugeot's ahead of two Renault's in the top spots, confirming the disruptive times in this market and the end of a cycle.

But the Climber of the Month was the Tesla Model 3, that jumped into #6, and should jump higher next month, possibly to 4th.

In the city car category, the #7 Renault Twingo EV and #8 Fiat 500e are separated by just 153 units, so this category is starting to look like an entertaining race to follow throughout the year.

On the second half of the table, we now have the VW ID.3 in #17, while the BMW X5 PHEV is now #20, having surpassed its Mercedes GLE350e/de rival, but has the rising #21 Ford Kuga PHEV just 3 units behind, so BMW's yacht will probably disappear from the table next month.

Looking at the manufacturers ranking, the new leader Peugeot dropped 2% in share, to 22%, but it is enough to stay ahead of the runner-up Renault (16%), while Kia (6%, down 1%) keeps its 3rd spot, ahead of Citroen, Volvo and Tesla, all with 4% each.

As for OEMs, Stellantis is now the major force here, with a commanding 35% share, with the Renault-Nissan Alliance far behind, with only 17%, while the best foreign OEM is Hyundai-Kia, with 9% share.

The Stellantis Group is starting to become a force to be reckoned, betting on a broad lineup, distributed by its 106 brands, that is not dependent on the behavior of a single model and allowing it a massive scale, that will help it play relevant roles in several major markets, with the exception being Asia, and most specifically, China, where they lack a competitive local associate.

With the French and Italian markets now in the bag, and Opel regaining some relevance in its native Germany, the only domestic market left for the Stellantis conglomerate to make their mark is the USA, where Jeep (upcoming Wrangler PHEV, future Wrangler EV...) seems to spearhead the Group efforts (now, about that Ram EV...), but for now, the American arm of Stellantis seems to be the laggard among the Detroit Big 3.

(Well, not long ago, Renault seemed unbeatable in France...)

Renault at least tried to make an affordable PHEV with Captur.

ReplyDeleteA more affordable solution and better alternative to diesel would have been using

Nissan's e-Power and adding a Plug and larger battery.

Why do you think that would be more affordable? It trades a bit of saved mechanical complexity for a need for more powerful batteries, generators and drive units... And more difference from the combustion-only variant -- which worsens economies of scale.

DeleteWhile it would certainly improve the user experience, I doubt it would reduce costs.

@antrik

DeleteWhen Note e-Power was introduced in Japan it cost only 1000 Euro more than a gasoline version.

A PHEV on average is 10,000 Euro more than a gasoline version.

So if they'd spend 3000 on a battery, people could save a lot on fuel cost. Even without incentives. Including incentives it would sell like crazy.

Does Japan have some sort of (direct or indirect) incentives for HEVs? I can't imagine the production cost difference is anywhere near that small.

Delete(And a PHEV adds more than just the battery cost: it also needs a charger and charge port; additional controls; and it needs to fit a decently sized battery -- which requires some changes in the production process... Albeit not nearly as much as a BEV.)

BTW, I call BS on your 10,000 Euro figure. PHEVs wouldn't be selling nearly as much if the difference was anywhere close to that...

@antrik

Delete10,000 minus incentives.

Just calculate.

Yeah no: it would still make them significantly more expensive than combustion-only models in almost all markets -- i.e. we wouldn't be seeing the massive sales to customers who only want the incentives, without actually intending to charge them.

DeleteThe high Tesla number in February does not necessarily mean there will be a record in March... Might just mean that for some reason, this time around they shipped here first. Wouldn't be the first time something like that happens...

ReplyDeleteEither way, things are getting exciting here :-)

That's why i wrote "it could mean", i haven't said it was a certainty.

DeleteBut it's an interesting thought, nonetheless.

Well, with actually 10 boats headed for Europe this quarter (all-time high), it seems that we should indeed see absolute records in many markets in March :-)

DeleteJosé, I have a question about 2020 results in regards to SAIC Motors. On their website they claim to have sold 320,000 NEVs in 2020. You have written in your "2020 Sales by OEM" article, that they have sold 272.210 EVs in 2020. Both figures include SGMW. Where does the difference come from? Is it because of the Chinese definition for what New Energy Vehicles include, is it because you only count passenger vehicles and they probably (light) utility vehicles, or what is the reason for the 47,790 units difference? Thanks

ReplyDeleteSAIC also has Buses and Commercial Vehicles divisions, so i would assume they would count them all together to reach that 320k number.

DeleteI remember a couple of years ago (2018?), when Tesla became the #1 EV brand globally, BYD issued a press release saying they were the "true" #1 EV brand that year, outselling Tesla, but then, looking to the fine print, i noticed they were adding Buses and Commercial Vehicles to the total...

...So it doesn't surprise me that SAIC does the same.

So you say it is because of the types of vehicles they include and because of the definition what constitutes a "New Energy Vehicle" in China?! SAIC wouldn't lie if they include buses and commercial vehicles, because the release doesn't refer to the 320,000 units as passenger cars but as NEV, which can include passenger cars, buses and commercial vehicles.

DeleteAnd exports. Don't forget that SAIC is the biggest EV exporter in China, including on the LCV category.

DeleteIs that actually more than just a couple thousands per year globally?...

Delete18k Passenger cars exported in 2020 and a couple of thousand LCVs in the same period.

DeleteIt could be more, those 20k (cars+LCV) are just what i got on my radar.

De hecho estos vehículos (buses, camiones....) deberían contar al menos x4 pues sus emisiones superan ampliamente la de cualquier turismo.

ReplyDeleteTesla SX it isn't selling...

ReplyDeleteNot delivering, you mean... Big surprise, considering that they stopped production while switching to the new generation.

Delete... all of them sold-out? -> Not!

DeleteStopped production??? Stupid Tesla management, now that the annual installed capacity reaches 100.000 units.

Ah yes, how stupid of them: they haven't even figured out the magic trick for changing production lines without pausing production! [facepalm]

Delete48k bus truck is extremely large. Even byd and yutong are much less than that.

ReplyDeleteThere must be other factors.

"In transit", exports, other brands?

Well, BYD isn't exactly the biggest bus maker... Despite being by far the best-known outside China, since they are the only one selling globally.

DeleteHaving said that, SAIC isn't exactly a big bus maker either AFAIK (and trucks are still a pretty tiny niche, even in China) -- so indeed clearly there must be some other reason for the large discrepancy.

It's not only Buses and HD Trucks, it's also light commercial vehicles, where Maxus has a strong presence, not only in China but also in a number of export markets.

DeleteBut yes, i believe i might be missing some export markets, as LCVs are a harder category to get numbers.

In 2014, PSA / Tavares deliberately opted for EV's + hybrids. Only EV's wasn't viable for a number of reasons. So, no PR talk like a major competitor does. No "We invest €60bn in EV's in during the next 5 years". Solid choice: PSA reached (during a C-19 year and despite 20% lower salesvolume) a stunning and record operating margin 3x that of BMW and 18x that of VW: 9,4%. (VW 0,4%, BMW 2,7%). Textbook management and a case study at INSEAD / Fontainebleau.

ReplyDeleteCool story, bro: except that BMW is at least as PHEV-heavy as PSA, yet *somehow* that hasn't saved them...

DeletePas du tout!

ReplyDeleteAlthough PSA has been implementing a turn around/expanding programme, the truth is that at the end of the line, paytime will come and that is going to be the moment of truth.

Meanwhile, 10.000 plus Peugeot franchisees can't get much more excited learning that their just about finished expenditures into the new corporate look of sea of blue with 3 lines of chrome is on the way to the bin so that a world of black and a few whites kick in. They are as much annoyed and agashed as their colleagues at Renault, that after scrambling to comply with the directive to introduce black in the corporate look, they now are told that the Losange is on the way to a change too.

Guess who where #1 and #2 best selling vehicle in Europe in Feb? Peugeot 208 and Peugeot 2008! A first!! Seems many - fed up with lockdowns left and right - treated themselves with best-n-class wheels from France.

ReplyDelete