|

Models: Nissan Leaf resists the BAIC EC-Series in (another) Record month

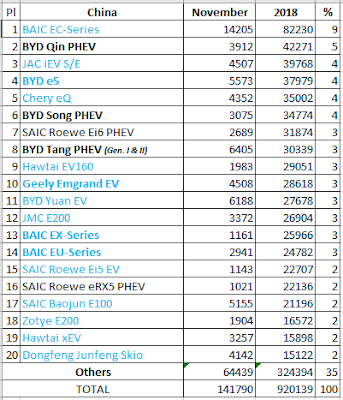

Registrations grew 73% YoY in November, to over 237,000 units, continuing for the third time a streak of record months.

This brilliant performance set the yearly tally straight into the 2 million PEVs mark, a stark departure from the 1.2 million of 2017.

Because of this, the global PEV share grew once again, crossing into 2% share, with December probably placing the final 2018 share north of that value.

In November the question at the top was knowing if the Silver Medal would change hands, with the BAIC EC-Series failing to overcome the #2 Nissan Leaf, but with only 400 units separating them, it seems December will finally see the Chinese nameplate reach the Second Place.

Another interesting race is happening at #6, with the Prius PHEV, Toyota's only plugin model, trying to resist the Tesla Model X, with less than 1.000 units separating them and the Californian going into warp speed in December, the Japanese is set to lose another spot until the end of the year, thus losing four positions, comparing with 2017. Do i hear an alarm call at Toyota HQ? Are they listening?

As for the remaining YTD ranking, the BYD e5 is now #9, that thanks to another record performance (5.574 deliveries), it climbed one position.

The Chery eQ and Renault Zoe climbed one position each, to #11 and #12, respectively, with the French hatchback hitting a Personal Best result of 5.370 deliveries, while the BMW 530e continues its seemingly never ending rise, now climbing to #14, thanks to a massive 5.164 units, the best result ever for a BMW plugin.

Interestingly the other BMW on the Top 20, the i3, also improved in the ranking, up one position to #16, scoring 3.468 units, a new record for the German hot hatch.

But the Climber of the Month was the BYD Tang PHEV, that jumped two positions, to #17, thanks to a record 6.405 units, a new all-time best for a BYD model, at this pace, the Chinese SUV could even end the year at #15.

Finally, we have a new face in the Top 20, with the BYD Yuan EV reaching #20, thanks to a record 6.188 registrations, being not only the best candidate for Rookie Of The Year, but also the Fifth BYD in the 2018 Global Top 20...

|

Best Selling EV maker in the World

|

Manufacturers: BYD wins November, Tesla #1 YTD

November saw BYD win the monthly Manufacturers title, thanks to a record 29.000 units, being its first win since April.

With Tesla ramping up to what can only be an historic December (over 40k?), the American maker has enough YTD margin from BYD, to keep comfortable in the leadership, even if BYD pulls out a 30k-plus performance.

One thing is certain, right now BYD is the only maker able to follow Tesla's pace.

Coming down from Outer Space and back to Earth, the #4 BMW broke its personal record, mostly thanks to the Chinese deliveries of the 530e, while the most important change is Nissan climbing to #5, thanks to a record 11.362 deliveries, that can attributed to the deliveries ramp up of the Nissan Sylphy EV in China.

Interestingly, #10 Volkswagen had its best score (6.240 units) since 2015, in great part due to the start of its Chinese operations. Are we seeing a pattern here?...

Chevrolet recovered one spot, climbing to #8, thanks to a record 7.881 units, while another Legacy OEM also had a record month, with Renault registering 6.723 units.

Below the Top 10, Geely climbed to #12, while its Premium arm, the #18 Volvo, had a Year Best performance of 3.670 units.

Finally, we have a new brand on the Top 20, with Dongfeng climbing to #20, thanks to a record 8.754 deliveries last month. And to think the manufacturer delivered 3.158 units in the whole year of 2017...

Grouping sales by brand origin, China has once again increased its leadership, to 49% (+1%), with the USA (16%) stable in Second, and the #3 Germany (13%, down 2%) is losing steam.