|

| Kona EV: Is Hyundai's electric crossover finally ready to fulfil its potential? |

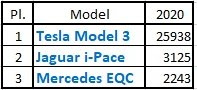

Models: Tesla Model 3 rules recovering market

Registrations were down 23% in May, a slight recovery from the 30% drop in April, while the YTD numbers are now down 14% regarding the same period last year, with 718.000 registrations.

If in isolation these numbers aren't exactly positive, comparing with the overall automotive market, numbers are even worse than in the plugin niche, with sales down 33% in May and 30% this year, because of this, May's PEV share repeated April's result (2,8%),keeping the 2020 plugin share at 2,7%,which is already above the 2,5% of last year.

The future will depend much on the development of the pandemic and the gravity that the subsequent economic crisis, but expect plugins to weather the storm better than the overall market, increasing its PEV share on the way.

In May, BEVs dropped faster than plugin hybrids (-28% for BEVs, -9% for PHEVs), but despite that, the BEV/PHEV breakdown remained stable at 67% BEV, 33% PHEV.

With a helping hand of the Chinese EV market, the Tesla Model 3 reigned supreme in May, more than tripling the sales of last month #2, the GAC Aion S. with 3.892 deliveries.

If the podium positions seem secure for now, but below them, the BMW 5-Series is running after the #4 VW e-Golf, with only 560 units separating both.

If the podium positions seem secure for now, but below them, the BMW 5-Series is running after the #4 VW e-Golf, with only 560 units separating both.

But there is more action on the top half of the table, with the Hyundai Kona EV surpassing the Audi e-Tron and reaching #8, with both the Hyundai crossover and the Audi EV now going after the #7 Mitsubishi Outlander PHEV, with the Japanese SUV possibly losing 3 postions at once in June, as even the rising #10 GAC Aion S (3.892 units in May, new Year Best) has also a shot at surpassing it.

Other models on the rise are the BAIC EU-Series climbing to #14, while the NIO ES6 joined the table, in #16, just like the #20 Volvo XC60 PHEV, that recovered its spot on the table.

Outside the Top 20, and while the highly expected Tesla Model Y doesn't join the table soon (in June?), we see two Chinese EVs getting ready to get there, with SAIC's Baojun E-Series (7.798 units, 2.447 of them last month) and the Li Xiang One (7.666; 2.148) are likely to join the table soon.

Manufacturers: Tesla and BYD shine

May saw Tesla win another monthly Best Seller title, more than doubling the result of the #2 in May, BYD, with the Chinese maker repeating April's runner-up spot...Is BYD returning to the good old days?

One thing is certain, the Silver medal of the #2 BMW is looking pretty shaky, with the #3 Volkswagen shortening slightly the distance (683 units separate both makers) to it, while BYD is looking also to kick out BMW from the runner-up spot in a couple of months...

Others makers on the rise are Audi, than jumped two positions in one month, to #6, displacing Renault to #7, this was a terrible month for the Renault-Nissan Alliance, as all three brands dropped in the ranking, showing the real need for fresh models in their showrooms, as their 3 Best Sellers are getting long on the tooth, if counted together, they already have 23 years of activity on the market, making an average age of over 7 years, so the Nissan Ariya and Renault Mégane PHEV (among others) are badly needed.

The Alliance also needs to do something about China, if Renault always had problems to affirm itself in the largest global automotive market, it is hard to understand why Nissan is acting so passively there.

The Alliance also needs to do something about China, if Renault always had problems to affirm itself in the largest global automotive market, it is hard to understand why Nissan is acting so passively there.

In other news, the Korean Kia was up one spot, to #10, while on the second half of the table, GAC (4.254 units, new Year Best) climbed to #14, while NIO joined the table, in #18.

Outside the Top 20, there are a few Chinese brands preparing to join the table, and in the middle of them, we find Ford (hey, remember me?) also trying to return to the table, with the Dearborne maker now less than 1.000 units behind the #20 Porsche, with the American brand scoring a record performance last month (2.624 units), thanks to the success of its new Ford Kuga PHEV.