Models: Wuling Mini EV #1 in April

Monday, May 31, 2021

Global Top 20 April 2021

Thursday, May 27, 2021

Europe April 2021

1-2 win for Volkswagen

BEV D-Segment / Midsize category

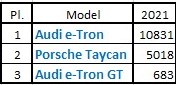

BEV E/F-Segment / Full Size category

Monday, May 24, 2021

China April 2021

10% share!

Plugins are a hot item in China, having scored over 175,000 units last month, jumping 173% regarding the same month last year, with BEVs in particular growing an amazing 204% rate.

April was the second month in a row that the plugin share reached the two-digits mark, by hitting 10% (8.2% BEV), keeping the 2021 share at 10% (8.1% BEV), and considering that Q1 is usually China's weakest quarter, we can now safely assume that the local plugin market share will end North of the two-digits mark this year, and the total tally of the year will exceed 2 million deliveries!

After Europe, #EVDisruption is now reaching China...

Looking at April's Best Sellers, the biggest news is the 4th spot of the Li Xiang One, with the full size SUV ending just 207 units the #3 BYD Han EV, something that would be a first for the startup maker.

Here’s April Top 5 Best Selling models individual performance:

#1 – Wuling HongGuang Mini EV

With 29,251 units last month, the tiny four seater continues on a roll, allowing it to keep the 3rd spot in the overall market, if the little Wuling continues to go at this pace, a half a million score by the end of the year seems not only feasible, but likely. The Wuling EV is becoming a disruptive force in urban mobility, a true EV for the masses, with the added bonus that the people buying it (mostly females, mostly under 35 year olds) are usually a hard to capture audience. This EV is becoming a game changer, but like in every success story, one wonders what will happen when others start to play in this field...

#2 – Tesla Model 3

The poster child for electric mobility had just 6,264 units last month, but fear not, considering that part of the MiC Model 3 production is now being exported to Europe and the Asia-Pacific region, we should start to see it behave in China like it does elsewhere, meaning poor starts of the quarter, so-so mid quarter months and then an end-of-quarter peak, replicating the behavior of the US-made Model 3. Something we will no doubt have the opportunity to check in the next couple of quarters...

#4 – Li Xiang One

...Big SUV from Li Xiang. A sort of Dark Horse among the whole Chinese EV Startup buzz, the little talked about EREV has already delivered over 55,000 units in just 17 months, an amazing performance, especially when we consider that this is a huge 5-meter, 7-seater, full-size SUV. Using an original strategy when it comes to powertrain, being one of the few Extended Range Electric Vehicles on the market, it adds to the 41 kWh battery with fast-charging capabilities, a 1.2 liter gasoline engine that works as a range enxtender. With production (and demand?) now in cruise speed, one wonders when will this EV startup launch its 2nd album model, after all, their counterparts in the movement (NIO, Xpeng, etc) are already on their 2nd, or even 3rd, new model...

#5 – Tesla Model Y

Tesla's new baby had only 5,407 units last month, and while at first sight it looks like a disappointing result, this is mostly explained by the 2 week shut down in April, expect it to recover soon and maybe resume the records streak by June. Tesla’s midsize crossover future cruise speed in China is a question mark, while traditionally SUVs/Crossovers haven't sold as much as their sedan counterparts, the truth is that the market is leaning towards higher riding bodies, so the Model Y could surf the wave and outsell the Model 3 by some margin.

Looking at the remaining Best Sellers table in April, a mention to the rise and rise of the #10 Hozon Neta V, a small crossover from Hozon that has delivered 3,846 units last month, the 2nd record performance in a row for the EV startup model, so we might be witnessing the build up of another star in the Chinese EV startup sky.

Another model with surging sales is the new BYD Qin Plus PHEV, 12th last month with a record 3,603 units, its third record score in a row, so it means that the new midsize BYD is still in production ramp up, with the Shenzhen maker hoping to replicate the Han success in the category below.

The #18 SAIC Roewe RX5 PHEV had 2,499 units last month, the SUV's best score in 34 months, while the #15 BYD e2 hatchback hit a record score of 2,903 units.

Local startups continue to shine, besides the aforementioned Hozon Neta V, in total we had 7 representatives from 6 different startups in the table, with the highest placed being the #4 Li Xiang One.

Below the Top 20, a reference to the landing of the GAC Aion Y, with a great 2,000 units score, so the compact MPV (Yeay! MPVs rule!), seems to have started off its career on the right foot, after one failure (Aion LX) and one meh! launch (Aion V), this is an important model for GAC, that has been solely living off the success of the Aion S for years and it desperatly needs more successful metal for the company to grow and avoid the one trick pony moniker.

On the VW Group galaxy, the VW ID.4, continues to (slowly) ramp up production, with the SUV having 1,644 units last month (922 from the ID.4X and 722 from the ID.4 Crozz variants), while their Chinese arm SOL (as in, rebadged JAC's) saw the small E10X hit a record score of 2,249 units.

Looking at the 2021 ranking, the top positions all remained the same, with the Wuling Mini EV as the undisputed leader, with the runner-up Tesla Model 3 also comfortable, so unless something unexpected occurs, the top two positions are already taken for

Below it, the Tesla Model Y got a little bit closer from the #4 Great Wall Ora Black Cat, that had an off month in April, with Tesla's SUV set to surpass the small Cat in the next couple of months.

The first position change happened in #10, with SAIC's small Clever EV jumping three spots into the top half of the table, while in #12 we have the Hozon Neta V, that also jumped 3 positions, and we should see it climb even higher, given the current records streak that the small crossover is experiencing.

The BYD Han PHEV is also experiencing a success of its own, having climbed to #16 last month, while another EV startup model has joined the Top 20, with the small Leap Motor T03 jumping to #19, being the 7th EV startup model in this Top 20.

Just outside the Top 20, we have two models on the rise, with the #21 Xpeng G3 just 70 units behind the #20 Ora White Cat, so the crossover might already join the table next month, while the BYD Qin Plus PHEV is some 800 units below the Top 20, and given its current production ramp up process, it wouldn't be that surprising if it joined the table already in May.

Looking at the makers ranking, the SGMW joint-venture (20%, down 1%) is in the leadership, while below it, Tesla (12%, down 2%) is just 2,000 units ahead of BYD (12%, up 1%), but expect the US maker to gain significant ground again, in June.

Below the podium, SAIC (7%) is 4th, followed by the #5 Great Wall (6%) and the #6 NIO (4%, down 1%).

Interestingly, the all-mighty Volkswagen Group, owner of 16% of the overall Chinese passenger car market, currently has only 5% of the plugin market, a number that pales next to the 27% share of the SAIC Group, or even the 12% that both BYD and Tesla have, so a lot needs to be done, if they still want to keep their grip on the market in the long term.

Thursday, May 20, 2021

Germany April 2021

1-2 win for Volkswagen

The German plugin market scored over 50,000 units last month, with both technologies rising fast (+413% for BEVs and +380% YoY for PHEVs), with last month plugin share ending at 22% (10% BEV), in line with the yearly tally of 22% (10% BEV), so this market is firmly in The Disruption Zone.

Tuesday, May 18, 2021

Netherlands April 2021

Skoda Enyaq lands in hot market (21% share!)

Saturday, May 15, 2021

France April 2021

Peugeot shines in hot market

Other Stellantis models climbing positions were the Fiat 500e and Citroen C5 Aircross PHEV, with the small EV climbing to #7 and the SUV to #8.