Was? The Model 3 is eating our lunch? Counter-strike!

The European passenger plug-in market registered some 55,000 registrations in November (+44%), with the Dutch market and plugin hybrids (+80% YoY) to pull the market uo, while BEVs (+23%, lowest growth rate since June ‘18), are waiting for the 2020 flood, leading to an even (53% BEVs / 47% PHEVs vs 64% / 36% YTD) breakdown between both technologies, in November.

With plugin hybrids picking up speed, PEV’s climbed to 4.6% (2.4% for BEVs alone), pulling the 2019 PEV share to a record 3.3% (2.1% BEVs), above the 2.5% result of 2018.

With the two EV best sellers (Model 3 and Zoe) expected to have strong results in the last month of the year, PHEVs continuing to experience a surge and the Dutch market expected to have an Historic month in December, we should see the European market hit a new record next month.

The big news in November were the big results of several midsize cars, with the leader Tesla Model 3 (7,380 units in December, best off-peak performance for the Californian) working as the ignitor for legacy OEMs finally going all in in plugins, with the BMW 330e jumping to 5th in November, with 2,666 registrations, the model’s third record month in row(!). With the Bavarian suffering the biggest bleed from the Model 3, after all, it was the Bimmer that used to be known for the Ultimate Driving Machine, BMW is going all in for the 330e patch, in order to cut the bleeding, at least until the i4 antidote is not deployed, but even other brands, not so directly impacted by Tesla, like Mercedes and Volvo, are increasing their plugin efforts, with the S/V60 PHEV twins from Volvo reaching 828 registrations last month, while the Mercedes C300e/de twins have also hit 1,207 units, the best result for the three-pointed star midsize plugin since December 2016.

So, while the Model 3 isn’t creating enough gravitational force to become a black hole, like in the US, it’s strength is forcing the usual suspects to step up their game. Win, win, right?

Looking at the Monthly Models Ranking:

#1 Tesla Model 3– The poster child for electro mobility had its off-peak best month so far in Europe, with 7,380 deliveries, with the Model 3 benefiting from the Dutch EV year end rush and scoring 3,973 units in the Netherlands, but the UK, possibly the only European market not being starved by the Netherlands fever, also helped, as it had some 1,500 deliveries, while the remaining markets somewhat underperformed (452 units in Norway, 231 in Switzerland and 225 in France), affected by the fact that Tesla Netherlands was grabbing every available unit they could get their hands on. With the continuing of the backlog deployment in the UK, and record deliveries expected in the Netherlands, December could see another record month for the Tesla midsizer, even if most of the markets will be still suffering from starvation, which in turn will create (another) deliveries peak in Q1 2020. By the look of it, we should only know the organic demand of the Model 3 in Europe in second quarter of next year, or over a year after the landing of the sports sedan. Amazing, isn’t it?

#2 Renault Zoe– The 3,231 deliveries of November meant falling deliveries (-39%), due to the current skin change, meaning that some countries saw their registrations drop significantly (Germany, only 321 units), but still, enough units were deliveried in key markets (France, 1,866 units, or Italy, 253 registrations) to place it in Second Place. December should see it back into the growth path, with the French hatchback getting ready for a strong start of 2020, and it will need it too, as the Peugeot 208 EV and Opel Corsa EV should start to cast their (small) shadow over the Renault EV in a few months...Will the Zoe get into trouble with those two?

#2 Renault Zoe– The 3,231 deliveries of November meant falling deliveries (-39%), due to the current skin change, meaning that some countries saw their registrations drop significantly (Germany, only 321 units), but still, enough units were deliveried in key markets (France, 1,866 units, or Italy, 253 registrations) to place it in Second Place. December should see it back into the growth path, with the French hatchback getting ready for a strong start of 2020, and it will need it too, as the Peugeot 208 EV and Opel Corsa EV should start to cast their (small) shadow over the Renault EV in a few months...Will the Zoe get into trouble with those two?

#3 Volkswagen e-Golf– The evergreen German model hit 2,753 units last month, dropping 11% YoY, which is still a meritable result for a model that was supposed to be in sunset-mode for several months now… and has its sucessor now starting to roll of the Zwickau factory line. It seems VW is going all in into plugins, milking everything it can from its current best selling electric model, even if it isn’t the best EV on the market. Regarding the November performances, the Volkswagen EV main markets were three, with Germany (925), Norway (803) and the UK (300), gobbling most of the deliveries.

#3 Volkswagen e-Golf– The evergreen German model hit 2,753 units last month, dropping 11% YoY, which is still a meritable result for a model that was supposed to be in sunset-mode for several months now… and has its sucessor now starting to roll of the Zwickau factory line. It seems VW is going all in into plugins, milking everything it can from its current best selling electric model, even if it isn’t the best EV on the market. Regarding the November performances, the Volkswagen EV main markets were three, with Germany (925), Norway (803) and the UK (300), gobbling most of the deliveries.

#4 Nissan Leaf – With the 62 kWh version being delivered in volume, the Japanese model hit 2,722 units last month, which is a 42% drop. Worse still, this in the context of a fast growing market... Auch. Will the Nissan BEV be able to leave this downward spiral? Unless Nissan cuts prices significantly, and i am sure by now Nissan has more than enough margin to do it, the Leaf is looking irrelevant and outdated, especially next to a certain VW ID.3 …But back at November performances, the Japanese main markets were the Norway (535 units), the UK (500), The Netherlands (418), France (241) and Sweden (224).

#4 Nissan Leaf – With the 62 kWh version being delivered in volume, the Japanese model hit 2,722 units last month, which is a 42% drop. Worse still, this in the context of a fast growing market... Auch. Will the Nissan BEV be able to leave this downward spiral? Unless Nissan cuts prices significantly, and i am sure by now Nissan has more than enough margin to do it, the Leaf is looking irrelevant and outdated, especially next to a certain VW ID.3 …But back at November performances, the Japanese main markets were the Norway (535 units), the UK (500), The Netherlands (418), France (241) and Sweden (224).

#5 BMW 330e – The original 330e was launched in Europe in 2015, basically as a compliance PHEV, with a symbolic 7.6 kWh battery, but despite it, it still managed to move some metal, sometimes reaching four-digit performances, like the record 1,566 units of March ’17, but things have moved on since, and the Model 3 started seriously denting on the Bimmer sales, so the German maker had a change of strategy for the 2nd generation of the plugin hybrid, if the specs continue...Meh, with just 12 kWh on the battery, half of what the BMW X5 PHEV has, the sales/production are really in another level, with the German midsizer scoring a new registrations record for the 3rd time in a row(!) in November, with 2,666 units, becoming last month Best Selling PHEV. How high will the 330e go, it is anyone’s guess (5,000 per month?), but i think in this case the limit will be first found on the demand side...Anyway, in November, their biggest markets were the UK (1,100 units), Germany (416) and Portugal (What tha...Yeah, i know), with 203 registrations.

#5 BMW 330e – The original 330e was launched in Europe in 2015, basically as a compliance PHEV, with a symbolic 7.6 kWh battery, but despite it, it still managed to move some metal, sometimes reaching four-digit performances, like the record 1,566 units of March ’17, but things have moved on since, and the Model 3 started seriously denting on the Bimmer sales, so the German maker had a change of strategy for the 2nd generation of the plugin hybrid, if the specs continue...Meh, with just 12 kWh on the battery, half of what the BMW X5 PHEV has, the sales/production are really in another level, with the German midsizer scoring a new registrations record for the 3rd time in a row(!) in November, with 2,666 units, becoming last month Best Selling PHEV. How high will the 330e go, it is anyone’s guess (5,000 per month?), but i think in this case the limit will be first found on the demand side...Anyway, in November, their biggest markets were the UK (1,100 units), Germany (416) and Portugal (What tha...Yeah, i know), with 203 registrations.

Looking at the 2019 ranking, if Tesla can already order the 2019 Best Seller party for the Model 3 and Renault can think about finding a place for the silver medal of the Zoe, the 3rd place of the Mitsubishi Outlander PHEV now seems certain too, as the #4 Nissan Leaf failed to impress in November, ans the distance (1,894 units) now seems insurmountable.

The Japanese hatchback now should worry itself with keeping the 4th spot from the hands wheels of the #5 BMW i3, only 411 units behind.

Below the front runners, the Mini Countryman PHEV scored its best result since March, with 1,691 registrations, allowing it to climb one position, to 8th, while the BMW 530e (1,580 units, best score since March) was also up, to #11, switching positions with its 225xe Active Tourer relative.

BMW had another good month, as the 330e was also on the up, joining the ranking, in #20

The Daimler Group had reasons to smile about, with the Smart Fortwo EV and the E300e/de twins climbed one position, with the tiny two seater going up to #15, while the luxury sedan went up to #16.

A mention to the #19 Tesla Model S, that registered 855 units, its best off-peak performance this year, while the Model X scored 697 units, also its best off-peak result this year.

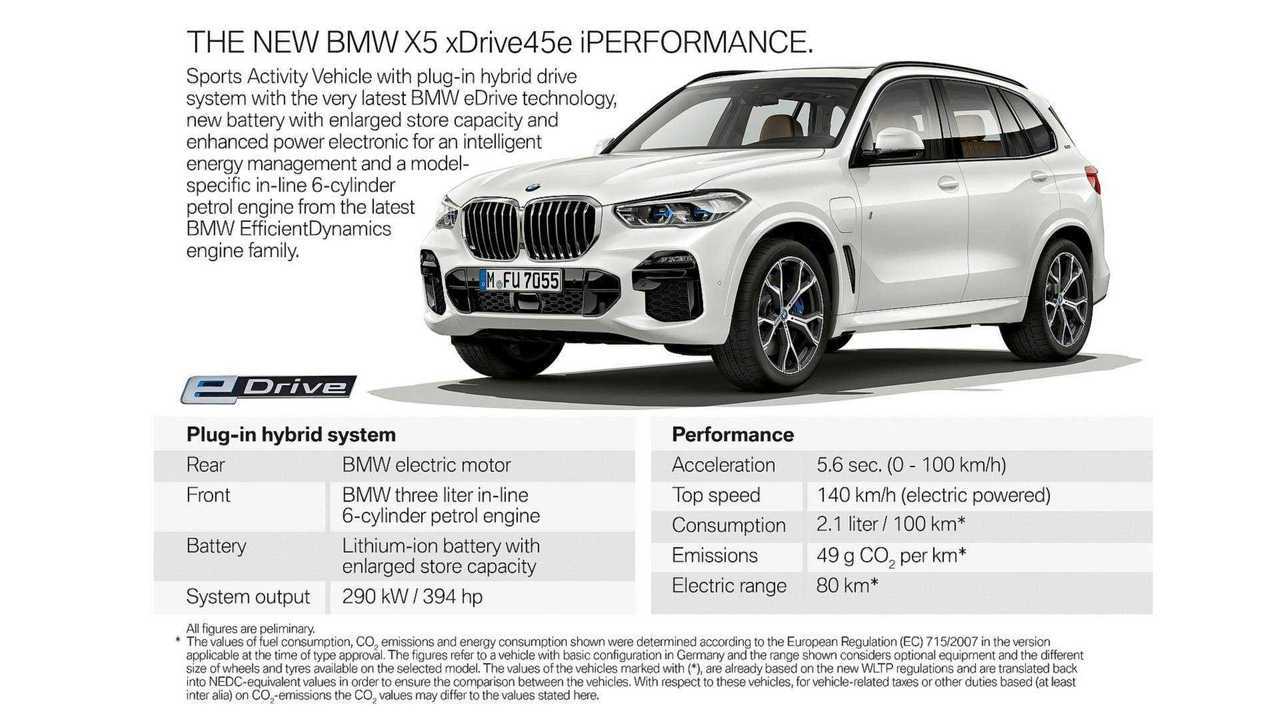

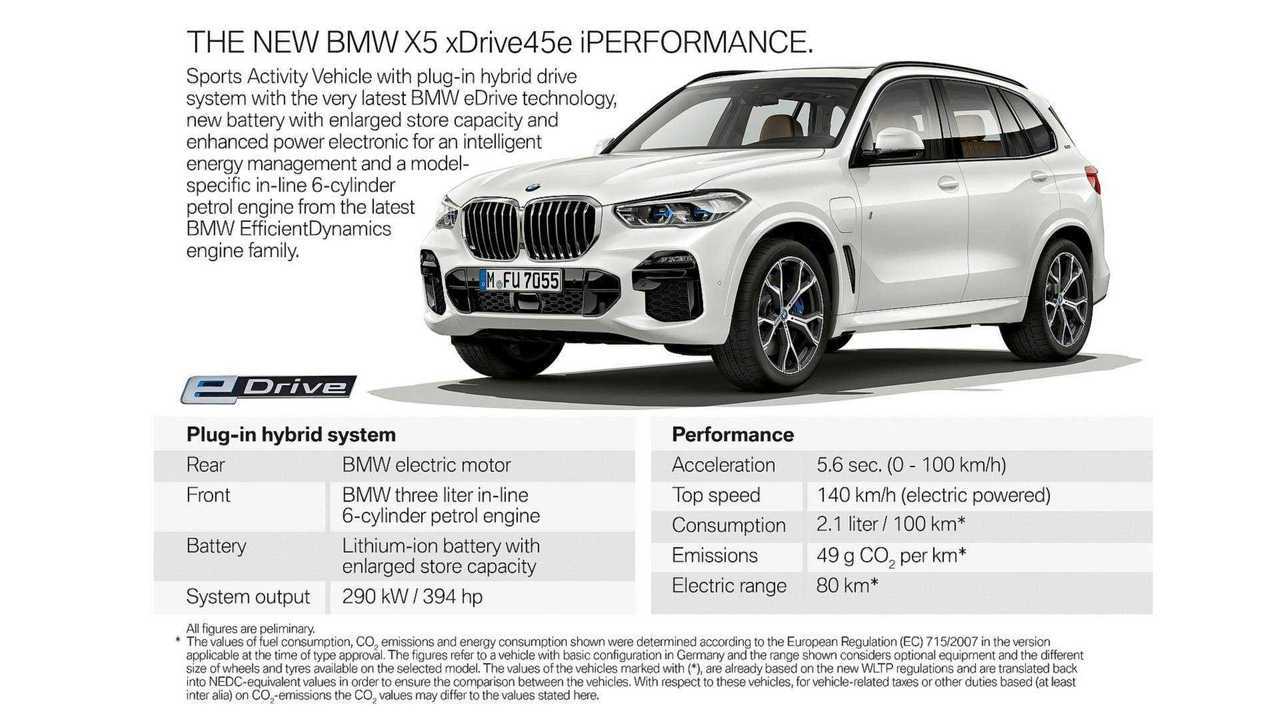

Outside the Top 20, besides the aforementioned good results from several European PHEVs, November brought two other brilliant results, like the popular VW Passat GTE scoring 1,875 units, the model best result of the last 3 years, while the new BMW X5 PHEV scored a record 1,068 units performance in only its second full month on the market, so it seems BMW’s long-range PHEV is set to become another success story for the Bavarian maker. Will we see it become the Best Selling Luxury plugin?

In the manufacturers ranking, Tesla (18%) is the leader, while last year winner BMW (14%) remains firm in the runner-up spot, ahead of Renault (9%), suffering from a short lineup, while Mitsubishi and Hyundai, stay outside the podium, both with 7% share.