Tesla high tide

The European passenger

plug-in market registered some 47,000 registrations in June (+24%), with the

PEV market growing 34% in 2019, a great performance considering the stagnating

performance (-3%) of the overall market.

In

June, while PHEVs had a horrible month (-38% YoY, worst drop since 2014), all-electrics

had some 34,000 deliveries (+98%), having been responsible for 73% of all plugin

sales last month (66% YTD), with the BEV share at 2.3%, while adding PHEVs to

the tally, the share climbs to 3.2%, placing the 2019 PEV share at 3.0% (2.0%

for BEVs alone), above the 2.5% result of 2018.

Looking

at other fuels, diesel sales continue its never-ending dive (-21% YoY), with

its share dropping to 31%.

The

big news in June was the expected Tesla high tide, with the Model 3 scoring

another 5-digit performance, while both the Model S & X had their best

results in 2019.

Interestingly,

despite the landing of the Tesla Model 3, all the remaining Top 5 Best Sellers had

25%-plus growth rates, meaning the Model 3 isn’t drying sales from other EVs,

but helping them to thrive.

Looking at the Monthly Models Ranking:

#1 Tesla Model 3 – After the March

deliveries peak, the posterchild for electromobility had its 2nd

deliveries peak in Europe, with 11,604

deliveries, with the sports sedan still benefitting from the reservations

backlog, with some markets already getting the SR+ versions, while in other

countries, like Norway, demand is high enough to be still delivering the AWD

versions, so expect another backlog-driven peak in September, so we should only

know the organic demand of the Model 3 in Europe on Q4 2019, if not

already in 2020. But back at June, looking at individual markets, the midsize model

was mainly delivered in Norway (3,012 units, best-selling vehicle in the

overall market), Netherlands (2,487, new record and best-selling vehicle in the

overall market), Germany (1,336), and France (1,097).

#2 Renault Zoe – The 4,881 deliveries of June signaled a new year best and a 43% growth

rate for the French hatchback, an impressive performance, considering the much

improved “new” Zoe and the upcoming Peugeot 208 EV (and Opel Corsa EV, etc),

are just a few months away. As for market individual performances, the Zoe

continues as popular as ever in its domestic market (1,845 units), and in

Germany (1,020 units), with the surprise being once again Italy (350 units), with

Renault being the main benefitter of the new local incentives.

#3 Mitsubishi Outlander PHEV – The stainless

steel Japanese SUV seems unfazed by the passing of time and the arrival of

new models, being the only PHEV able to follow the pace of the Best Selling

BEVs, with the Mitsubishi model scoring 3,580

registrations in June (up 67%!), continuing to be popular in the UK (650

units), but the new #1 market for the Outlander is now Germany, with 915

registrations, with Norway (540) being the third big market. The success of

this PHEV in the BEV-friendly environment is remarkable, but in the long run,

one wonders how long the Outlander PHEV will resist to the BEV wave (possible

answer: until 2021, when the Tesla Model Y and VW ID Crozz finally land),

although, with no direct BEV competitor landing soon, the Mitsubishi model

could still pick up a lot of sales this year without major worries.

#4 BMW i3 – The German hot hatch sales

were up 26% in June, to 2,520 units,

with the BMW pocket rocket benefitting from its unique formula (it is the

only Premium City EV in town) to continue expanding its sales, following

the EV bubble growth. Looking at individual countries, Germany (714 units),

Norway (453) and the UK (350) were the main markets. Looking into 2019, expect

the Star Wars-inspired EV to continue growing, being a regular face in this Top

5.

#5 Volkswagen e-Golf – Volkswagen’s

electric Golf managed to reach the 5th spot in June, with 2,246 units, up 55% YoY, an amazing

performance, considering the Wolfsburg Mother Ship has entered in full-ID-mode,

advertising the new BEV family like if it didn’t had already one successful

model in the market. But the e-Golf is here and still selling strong, profiting

from the strong name recognition, with the German EV main markets in June being

Norway (798 deliveries), Germany (635), and the UK (300).

|

| i-Pace: an expensive beauty |

Looking at the 2019 ranking, if the podium positions continue stable, the main news was the BMW i3

surpassing the Nissan Leaf and reaching the 4th spot, with the Japanese hatchback

dropping two spots in two months.

The Nissan

hatchback really needs a shot of the 62 kWh version to recover, although one

questions if the new version isn’t too little, too late.

The Jaguar i-Pace was

up to 10th, becoming the 7th BEV in the Top 10, and with the #9

Volvo XC60 PHEV just 176 units ahead, it shouldn’t take long for the British

Sports SUV to climb another position and become the Best Selling midsize

premium SUV, a title that should remain with the Jag until the landing

of the Tesla Model Y.

On the second half

of the table, there were several changes, the Audi e-Tron continues to climb

positions, with the German SUV up two positions, to #12, while the Kia Niro

PHEV climbed to #14 and the Smart Fortwo EV reached the #16 spot.

There was a new

entry in the Top 20, with the Tesla Model S resurfacing at #18 (12th

BEV in the Top 20), thanks to 1,670 units, and although Tesla’s flagship

deliveries were down 21% YoY, it was its best performance in 2019, so it seems

the veteran sports sedan has regained enough demand to sustain a Top 20

position this year.

The same can be

said about the Tesla Model X, that jumped to #21, just 65 units below the #20

Volvo XC90 PHEV, thanks to 1,118 deliveries, a new year best, but comparing

with the same month of 2018, deliveries were down 39%, a steep fall, and while the

reason for the Model S drop is home grown (the Model 3 is diverting sales from

it), the drop of the Model X has to be found elsewhere, as the Osborne-effect

of the Model Y alone does not explain this large drop, so yes, Tesla demand can

be diverted into other EVs, if they exist, of course.

Below the Top 20,

we should notice the good performance of the new Mercedes E300e/de twins, with 795

registrations last month, a near-record performance for the plugin E-Class,

placing the nameplate just 300 units from the Top 20.

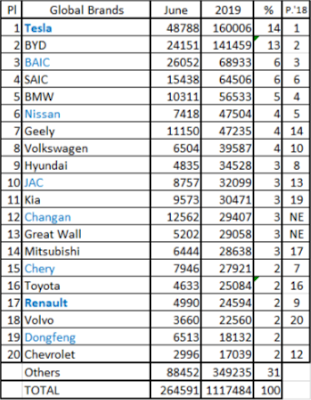

In the manufacturers

ranking, Tesla (17%, up 2%) is the leader, while last year winner BMW (13%, down

1%) remains in the runner-up spot, ahead of Renault (10%), in the 3rd

spot, with Hyundai and Mitsubishi not far behind, with 8%.