|

| BYD Tang: Getting easier on the eye every passing day… |

6,3% PEV

Share!

After two record-breaking months (September with 105k

and October, 120k), plugins in November just kept on pushing forward, by

registering over 140,000 units, up 59% YoY, with the previous record being

beaten by a significant margin (18%).

If we extrapolate December, sales could peak at some

155,000 units, with the 2018 sales surpassing the 1 million units mark. In one

year. And to think that 2017 was the first year that plugins reached 1 million

sales, GLOBALLY. Woah.

With all this continued growth, and the recent decline

of the mainstream market (-14% in November), the PEV share hit another all-time

best, ending the month with 6.3%, while the 2018 share rose to 3.8% share, a

new record and well above the 2.1% of 2017, with sales expected to continue

growing until December, the 2018 PEV share could end North of 4%, with the December

possibly reaching surpassing 7%.

If this growth rate continues throughout 2019, in a

year from now we should be talking about shares above 10%, and that’s when things

start to get interesting…

With symbolic export numbers, the domestic market is

more than enough to absorb the current Chinese production, and most foreign

OEMs only now are starting to tackle the current seismic changes, dragged into

electrification by the upcoming PEV quotas, resulting in the foreign brands total

share still being stuck at 6%.

Of this (small) cake, 2% belong to BMW, the Best-Selling

foreign brand, and 2% to Tesla, with the remaining manufacturers sharing the

final 2%.

In November, the headlining news were the BYD Dynamic Duo (Tang and Yuan) continued Rise and Rise, with the first nameplate

joining the Top 10.

Here’s November

Top 5 Best Selling models individual performance:

#1 – BAIC EC-Series: After the record 20,648 units

of October, BAIC’s small EV returned to more

normal performances, with 14,205

units being delivered last month. With almost twice as much registrations as

the #2 BYD Qin in 2018, the EC-Series continues to disrupt the Chinese market, replicating

what the Tesla Model 3 is doing in the USA. The revised design and improved

specs (new 30 kWh battery) allowed the EC-Series to remain a popular choice in

the Chinese Mega-Cities, also helped by a competitive price ($25,000, before

subsidies).

#2 – BYD Tang PHEV: After seven months on the market,

the second-generation Tang continues to expand sales, registering a record 6,405 registrations. Sales should continue

strong for BYD’s successful flagship, and new record sales could still be

achieved in the future, although the upcoming BEV Tang could steal sales from

it. As for the current Tang PHEV specs, BYD’s Sports SUV saw the battery grow to 24 kWh, originating an increased

100 kms range / 62 mi NEDC (around 70 kms / 44 mi real world), while on the

power department, things stayed the same, with some 500 hp and 0-100 kms/h in

less than 5 secs. All for CNY 279,800 / $40,816.

#3 – BYD Yuan EV: We all knew that BYD’s new Baby Crossover was destined for success,

and with a record 6,188 deliveries

in November, BYD’s new baby is living

up to expectations. Will the Yuan be the fiercest competitor in 2019 to the

all-conquering BAIC EC-Series? With a 40,000 waiting list, demand is no

problem, I guess it will depend more on BYD’s ability/willingness to make them

in large volumes (The Tang is more profitable…), than actual demand, sitting on

a sparsely populated part of the market (small BEV crossovers), and with

unrivalled specs (42 kWh battery, 305 kms/190 mi NEDC range, 174 hp motor), and

price (25,000 USD), BYD might have found in this new model its star player,

crowning what it is already a strong lineup.

#4 – BYD e5: BYD’s bread and butter electric

sedan, a favorite among taxi-drivers, registered a record 5,573 units in November, and yet,

this performance was overshadowed by the stars Tang and Yuan. This Andre

Iguodala (Who?)

of the BYD lineup, has some strong specs (61 kWh, 405 kms range NEDC, 218 hp),

for a competitive price (CNY 220,650 / USD 34,600). Unfortunately, the basic

design makes it a bit of an unsung hero in the BYD stable, next to the Tangs,

Qins, Songs and Yuans...

#5 – Baojun

E100: Shanghai

Auto and General Motors had high hopes for their tiny two-seater, and despite

an irregular career, it is finally starting to make an impact on the Chinese

plug-in market, having registered 5,155 units last

month, a year best. With an updated range in 2018 (250 kms NEDC), thanks to a

new 24 kWh battery, its price (CNY 93,900 / USD 14,700) before subsidies, is quite

alluring, especially considering its modern design and features.

|

| Junfeng Skio: Dongfeng's "EC-Series" |

2018 ranking

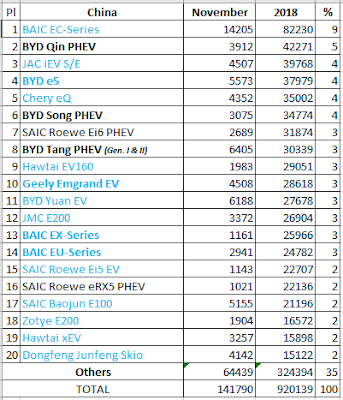

In a record

month, there were plenty of models shining, besides the aforementioned records

mentioned in the Top 5 Sellers, the #19 Hawtai xEV compact SUV registered a

record 3,257 units, while the #20 Dongfeng Junfeng Skio, a new face in this Top

20, scored 4,142 units, not only a new record for Dongfeng’s subcompact car,

but also for any of the maker EV nameplates.

There were

also some significant changes in the ranking, the Chery eQ climbed to #5, while

BYD’s star models, the Tang and Yuan, continue their never ending rise, with

the midsize SUV jumping three positions, to #8, signaling the Tang return to

the Top 10, while the subcompact electric crossover Yuan did even better,

shooting up four spots, to #11, while it prepares itself to join the Top 10 in

December, making 5(!) BYD’s in the Top 10...

That’s what’s

impressive about BYD, unlike others, that are dependent from their star player

performance (see LeBron James at the Cavs),

BYD has a constellation in its lineup, replicating the success formula of the

Golden State Warriors in the EV universe. And with looong waiting lists, the

Yuan alone has 40,000 reservations, the 400,000 units target that the company

has for 2019 seems quite feasible.

Outside the

Top 20, there’s much to talk about, the BMW 530e continues to amaze, having

scored yet another record performance, with 2,649 units, with the German sedan

being not only the bestselling plugin of its category, but also the best

performing foreign model, in #22.

But in

November the BMW model had a tough race for the Best-Selling Foreign Model

title, as the Nissan Sylphy EV started to fire on all cylinders charge

up at full speed, with 2,400 units being registered, so December should be an

entertaining race between both models, unless…

Unless the

recently arrived Volkswagens steal the show.

The midsize VW

Passat PHEV sedan landed with a bang, scoring 1,513 units in its debut month,

the best arrival for a foreign nameplate ever, while the compact SUV Tiguan

PHEV also scored a not negligible 618 units, so November signaled Volkswagen’s real arrival to this market, and

considering the German brand is the most popular maker in the country, expect

it to be a major player soon.

Elsewhere, the

Nio ES8 continues with its gradual ramp up (3,089 registrations last month), being

once again the Best-Selling Luxury SUV last month, allowing the new startup SUV

to remove the Tesla Model X from the yearly category leadership.

With the new

ES6 midsize SUV said to start deliveries by mid-2019, the Chinese startup is making

the best use of the short time it has to grow and win scale, before the Big Boys land with their dedicated BEVs.

Looking at

the manufacturers ranking, BYD (20%) is a comfortable leader, thanks to the new

Tang and Yuan, while the runner-up BAIC (15%), is finally profiting from the

EC-Series sales infusion to retain share, and in Third Place, the Shanghai-based

Roewe (7%) had a horrible month, with only 6,700 deliveries, its worst result

since February, allowing Chery (6% share) to come closer, now with hopes to

reach the podium, which would be the first time that Chery would win a medal since

2014.

Jose,

ReplyDeleteThe majority of PHEV sales in China in 2018 are concentrated with just brands: BYD and SAIC Roewe. At least for the part of PHEV sales in China that we see in the top 20 list.

BYD: more than 107,000

SAIC Roewe: more than 54,000

Can you tell us what the total number of PHEV sales in China is (in the first 11 months of 2018)?

And which PHEV models are there outside the top 20 list (like the BMW 530e)?

Cheers

In total, there are some 235.000 units and the main players outside thew Top 20, besides the BMW 530e, are the BMW X1 PHEV (8k), Geely Borui GE PHEV (10k) and GAC Trumpchi GS4 EREV (9k)

DeleteGreat news! The oil market is waking up to the fact that this fuel will no longer run the show rather sooner than later.

ReplyDeleteThanks for your awesome work on keeping us informed, Jose!

Jose,

ReplyDeleteThe 235,000 PHEV's out of the YTD total 920,000 means that the PHEV share in China in 2018 is 25.54%.

The Chinese Government has made the regulations for incentives for Plug-Ins tighter than before (in favor of long range BEV's).

That means that the share of PHEV's should decline in 2019, as the total number of Plug-In sales in China in 2019 is going to increase substantially (as a result of the 10% quota regulation in 2019).

But still, the absolute number of total annual PHEV sales in China in 2019 will still be higher than the total annual PHEV sales number in China in 2018.

What is your opinion about this?

Cheers

I think BEVs will continue to be the dominant force, but i believe a series of PHEVs coming from foreign brands is about to land next year, because of the NEV quotas, what is open to discussion is how successful they will be...

DeleteWith 45% of sales in the "other" category, the Chinese market is far more varied than other markets. You have the complete list on your subscription website?

ReplyDeleteThe dominance of BEV over PHEV is also noteworthy. Will changing rules for incentives make those BEV less popular?

Yes, EV Volumes covers dozens of PEV markets across the world, including the 100-plus PEV models in China.

DeleteIf you are interested in knowing more, please send me an email (efeelblog@gmail.com)

With the experience Nissan got with the Sylphy ZE (Chinese Sentra), they should do the same with the Nissan Sentra in the USA. I think the upsides are much larger than the risk of hurting the models reputation.

ReplyDeleteTrue. Maybe in late 2019 there will be some news on this topic...

DeleteDo you have any more info on JMC, the new partner of Renault? Is it an up and coming brand, or a brand that needs the support and know-how of Renault? I the 'significant' participation over 5%, or really significant like being consolidated in the Renault numbers?

ReplyDeleteWith the time these deals take in preparation, it is a nice coup for Ghosn from prison.

JMC is a small brand (Currently has 3% share), specialized in small cars (E100; E160; E200), and now is venturing into (slightly) larger formats (E300; E400).

DeleteI think it has an Ukranian arm (Bio Auto), too.

Renault know-how would help it to distance itself from its current "also ran" status and make it a leader in the small EV category.

Uncoincidentally, Renault is developing the Kwid EV city EV, so i guess it would make sense to have local input from JMC, someone that knows how to make successful small EVs in China.

I wouldn't be surprised if JMC also had their own version of the Kwid EV.

Ukrainian arm?) On its website Bio Auto says that it is official importer of "BIO Automotive Co."'s products

DeleteAnd models are called differently - http://www.bioauto.com.ua/model.html

How did Tesla do in November?

ReplyDeleteMiserably. As in, barely reaching three digits.

DeleteHow do you reconcile that with saying they got 2% of 140k? Why not give the percentage more accurately?

DeleteJose,

ReplyDeleteThe number of Plug-In models that are being sold in China is enormous.

And the total number of annual sales of Plug-In models in China is increasing substantially every year.

The annual total number of Plug-In sales in China in 2019 will be more than 1.5 million, and perhaps even very close to 2 million.

That makes China very special (in absolute numbers).

Could you therefore consider to make an exception in the case of China, and publish a longer list of the most popular Plug-In models in China? Meaning a top 40 instead of a top 20? Starting in January 2019.

Cheers

Sorry, i will keep it Top 20. As it is, it's already the post that takes longer to make, a Top 40 would be even more hour-consuming.

DeleteJose,

DeleteWould you appreciate it if you would get some assistance in all the work that you have to do in order to update and publish all the posts that you make?

Cheers

Depends on the assistance. send me an email: efeelblog@gmail.com

Delete