1-2 win for Volkswagen

The European passenger plugin market continues on the rise, having registered over 159,000 units in April, and 616,000 units YTD (+136% YoY), placing last month plugin share at 15% share (7.1% BEV), keeping the 2021 PEV share to 15% (6.7% for BEVs alone).

Interestingly, if in April the overall market was up 23% YoY, something that would be expected, after all, 12 months ago markets were all being disrupted by the Covid pandemic, if we compare April '21 with April '19, the overall market was down 25%, which says a lot on the current electrification process.

Growth came from both plugin fields, with BEVs recovering slightly in the plugin share (46% of sales in April, vs 45% YTD), mostly thanks to the BEV push from the Volkswagen Group, allowing the namesake brand to celebrate a 1-2 win in April, a first for the German maker.

Last year winner Renault Zoe was only 5th last month, its lowest standing in over 3 years(!), so after the Nissan Leaf (Best Seller in 2018, 7th in 2020, 16th now) and the Mitsubishi Outlander PHEV (3rd in 2019, 12th in 2020, now below the Top 20), the last bastion of success in the Renault-Nissan Alliance is also suffering, so the warning sirens must be ringing in the Renault & Nissan European HQ's...

Looking at April Top 5 Models:

#1 Volkswagen ID.4 – Sitting in the vortex of the current hottest trends (Plugins and compact Crossovers/SUVs) much is expected from the new Volkswagen, especially considering that its ID.3 sibling hasn't yet set the market on fire...The ID.4 doesn't have much margin for failure, and so far it hasn't disappointed, after the 5,000 units of March, April saw it reach 7,565 registrations and win its first monthly Best Seller award, but one wonders at which point will it reach the cruise speed, and how high will it be, because the fiercest ID.4 competitor comes from the inside the VW Galaxy and it's not the ID.3...(more on that below), but back at last month performance, the German EV had 3 markets in the four digits, with Norway (1,824 units), Germany (1,446) and Sweden (1,444) all scoring 4-digit performances.

#2 Volkswagen ID.3 – After the end of 2020 registrations rush and subsequent hangover, the German hatchback is slowly returning to form, by having 5,941 deliveries last month, its best score in 2021, allowing it to return to the podium and provide a 1-2 win for Volkswagen. Regarding April, the ID.3 performance was heavily based in its home market, with Germany taking almost 40% (2,264 units) of registratrions, being followed from a far by the United Kingdom (815 units) and Sweden (469).

#3 Ford Kuga PHEV – After a few battery issues last year, the Ford compact crossover, known as Escape in the USA, is back in top form, having been last month best selling plugin hybrid, with 4,300 units, thus ending a 3 month winning streak from the Volvo XC40 PHEV. With Ford now launching the much antecipated Mustang Mach E in Europe, one wonders if the Kuga PHEV will suffer from internal competition in the coming months. In April, Germany was by far the best market for the Ford nameplate, with 1,196 deliveries, followed by the United Kingdom (612 units) and Denmark (630), with the popularity of the Kuga PHEV in the Nordic country being a true case study, as the crossover was already the Best Seller in the overall Danish market in more than one occasion.

#4 Volvo XC40 PHEV - The smallest of Volvo's PHEV lineup continues its road to success, together with the popularity of the XC40 in the overall European market (compact SUVs/crossovers are all the rage now), with the Swedish carmaker selling their plugin hybrid versions as just another trimline in Europe, the XC40 PHEV has become a hot seller across Europe, and that is visible in the sales distribution, in April, the Belgian-built Volvo scored 4,118 registrations, with several markets scoring similar results, like in Germany (540 units), the United Kingdom (562), Italy (532), France (487) and Belgium (474). Without production constraints and experiencing strong demand, the compact Volvo remains the strongest candidate for the 2021 PHEV Best Seller title.

#5 Renault Zoe – The 4,083 deliveries show that the French hatchback is yet to recover from the last year end peak effort, and one now wonders if demand will ever recover, and this is especially more worrying when we consider the context of doubling sales in the European BEV market. In any case, the main markets in April were the usual, with Germany (1,268 units) leading, followed by France (1,265), while Italy (721), was a distant 3rd.

Looking at the remaining April table, one should highlight the Peugeot 208 EV ending less than 500 units behind its arch rival Renault Zoe, so the Pug could very well win soon the monthly sub-compact/B-segment Best Seller trophy, a first for the small Peugeot and also a mark in the rise of Stellantis as a major force in the market.

Still on the subject of Stellantis, the #6 Peugeot 3008 PHEV and the #10 Fiat 500e had their highest table standings this year last month, thus making 3 Stellantis models in the Top 10, a new record for the Conglomerate.

But looking at the Top 20, the OEM with the most number of models was the VW Group, with 5 models, all BEV, besides the aforementioned ID.3 & 4, the Audi e-Tron was 12th, the VW e-Up was 15th, and in #19 we have the Skoda Enyaq, that joined the table right in its first full sales month, and do not be surprised if the Czech-station-wagon-that-thinks-it's-an-SUV reached the Top 10 in May, as the Skoda EV is currently the most competitive MEB-based model one of the best EVs around, maybe even the best reasonably priced family EV in the market, with competitive pricing, space and practicality, without losing much in premium-ness to its VW counterparts...Actually, i believe the only thing stopping it from having even greater success is the badge itself, had it a more popular/"aspirational" badge and it could become the Best Selling EV in Europe.

Another OEM with a good month was Daimler, with 2 Mercedes and 1 Smart models in the table, with the popular GLC PHEV returning to a Top 10 position, while the Smart Fortwo EV continues to post solid results, despite its underwhelming specs.

Outside the Top 20, a mention to 4 BEVs in the vicinity of a Top 20 position, 2 from Stellantis, the Opel Corsa EV (2,272 units) and the crossover Peugeot 2008 EV (2,122), while the other 2 are from the BMW Group, with the Mini Cooper EV (2,283 units) ahead of the veteran BMW i3 (2,043).

Expect the Opel and Peugeot to reach Top 20 positions during the current months, something that the Mini should also achieve, as for the German EV...Come on, BMW put on a 55 kWh battery in it, the i3 deserves to end its career with a bang, and a new, bigger battery, would the the perfect excuse to do so, after all, its design continues fresh and it is still the best premium small EV around...And a future classic.

Looking at the 2021 ranking, the main news belonged to the ID family, with the Volkswagen ID.3 jumping two spots to the runner-up spot, while the ID.4 joined the table in #8, no doubt a temporary position, as VW's crossover should join the Top 5 in May, and from then on, a podium position shouldn't be that far away.

Now...will it be enough to displace the Model 3 from the leadership? I doubt it, with the Model Y production delayed, demand should remain strong throughout the next two quarters, and with 15,000 units separating it from the #2 ID.3, i just do not see how can either of the ID models reach within shooting range of the Tesla sports sedan.

A different question is looking at sales by brand or OEM, as currently Tesla in Europe is a one trick pony fighting against brands/OEMs with increasingly longer lineups. But more on that later...

Elsewhere, the Climber of the Month was the Ford Kuga PHEV, that jumped 3 spots, to #9, with the Spanish-made crossover now ambitioning a Top 5 seat.

The Mercedes GLC300e/de also had a good month, climbing to 12th, surpassing the Volvo XC60 PHEV and becoming the new midsize SUV Best Seller.

Still on the second half of the table, the Audi e-Tron climbed one position, to #18, but the big Audi is below last year performance levels, when it ended in 5th.

Just below the Top 20, we have the #21 Smart Fortwo EV, with 9,846 registrations, so we have three models (#14 VW e-Up; #20 Fiat 500e; #21 Smart Fortwo EV) separated by less than 2,000 units, somthing that should make the city car one of the most exciting races of the year.

Unlike the models ranking, where we already have a clear favorite, in the makers ranking, balance is the word, but Volkswagen (11%, up 1%), managed to earn an important edge over Mercedes and BMW, both with 10% share, with April possibly signaling the departure of the Wolsburg brand for a win in the manufacturer race.

Below these three we have the #4 Volvo, with 8%, while in 5th we have Peugeot (6%), now with a 1,000 units advantage over the #6 Renault (also 6% share), so it looks that in the race between the two French brands, the Lion is gaining momentum at the expense of its rival.

Looking by Automotive Groups, the Volkswagen Group is far and wide ahead, with 23% share, ahead of Stellantis (14%), Daimler and BMW, both with 12% share.

Do not expect the VW Group to lose their commanding position in Europe anytime soon, as neither Stellantis (not enough firepower in the higher end of the market), nor Daimler or BMW (not enough firepower in the lower end of the market) are in position to challenge the VW galaxy.

As for Tesla, even if the Model Y becomes a resounding hit next year, and the refreshed Model S/X are also met with success, i do not see them go higher than 14%-15% share by 2022, which is significantly more than the current 5%, but even in this optimistic scenario, the VW Group would still have some 18% by the end of next year.

BEV D-Segment / Midsize category

Tesla's midsize sedan lives in another galaxy, having won a sizeable distance over the competition, highlighting the fact that it won't have significant competition in the next few months, as the Tesla Model Y is delayed and the just arrived Ford Mustang Mach E (123 units in April, no doubt demonstration units) and upcoming Hyundai Ioniq 5 have the small demand -limiting issue that both come from mainstream brands and in Europe, midsize models from mainstream makers simply do not sell as much as premium brands (In the overall Top 10 midsize Best Sellers table, only two models, VW Passat and Skoda Superb, do not come from premium brands).

So yes, they might beat the current #2 Mercedes EQC, but that won't be enough to even get close to Tesla's sports sedan. Then again, in the unlikely event that demand would be over the roof for those two models, both Ford and Hyundai wouldn't have enough production to meet such demand, so...

Speaking of the Mercedes EQC, the electric SUV (1,764 units last month) benefited from Tesla's usual off month (just 1,244 units) to win April's trophy, ending some 300 units ahead of the #2 Polestar 2.

Outside the podium, the expensive Jaguar i-Pace (617 units in April), continues to outsell the BMW iX3 (565 units) that seems stuck at 500-something performances (no wonder BMW is already refreshing it...).

BEV E/F-Segment / Full Size category

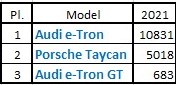

The e-Tron domination is unquestionable and the Audi SUV seems destined to win another category title this year, with Tesla basically giving up on the Model S & X for this year, what they will recover towards the end of the year shouldn't be enough to compensate for the current drought, while the #2 model, the Porsche Taycan (1,429 units last month) is too niche to go head to head with the e-Tron in the sales charts.

Regarding the remaining competition, the Audi e-Tron GT (303 units in April) has finally surpassed the Mercedes EQV Luxury Van, thus making a 1-2-3 lead for the VW Group.

But expect Mercedes to rebound in the second half of the year, with the new EQS, and especially in 2022, with the EQE, a model in which Mercedes has high expectations, namely by winning the category title, thus finishing the current Audi e-Tron domination.

Tesla: redneck breaking acceleration cars

ReplyDeletePlease, start adding tables per manufacturer. Info is there in the text, but most people miss it out, as it's not a pretty table picture.

ReplyDeleteGood point.

DeleteAnd which do you prefer, brand level or OEM level?

OEM Level is what is really interesting. After all, companies compete on the market, not brands or models: companies drive R&D and its technology that decides in the long run, who is winning, particularly in an industry going through a complete technological overhaul.

Delete"who is winning".... is terms of volume or profitability? Some manufacturers ship more units than others while 'the other' earns more money.

DeleteJosé, if you go with OEM level, maybe it would be interesting to put a column with how many different EV models sold by each OEM (but, I konw, it would be a lot of work with German OEM's plethora of models (maybe only with pure EV to simplify) !).

DeleteThe days when Tesla reached double-digit market share in Europe are definitely over for the next some years.

ReplyDeleteGive it a year, max two. Once Giga Berlin kicks into gear, Tesla will be dominating Europe.

DeleteNo it will not if the European market keeps on growing at current pace. Tesla Y is late, not first as it used to be with the previous models. If it doesn't address quality issues it will be kicked out of Europe as it happened with model S and X.

Delete@ anonymous May 27th

DeleteHonestly, I guess you are highly misinformed or do not hold much knowledge regarding Tesla strenghts/allure and capabilities; to be straight to the point:

Tesla shows historically all the inability to consolidate sales and build up, because before the introduction of the 3, the S was selling in very large volumes, they even managed to generate very good volumes for both S and X before the 3 became very evident/available. Then, it has been a bleeding, with Tesla not having any issues capturing customers for the 3, including people that otherwise would grab an S but now get a 3 instead...

The Model X has been now a total failure, residual sales.

With the Y available worldwide, the same S/3 relation is going to be mirrored into Y/3. No matter how many Plaids and Farts Tesla promises to throw in. And now, in Europe, there is an absurd amount of "mediocre EVs" that will have Zero issues in attracting EV customers, and then Tesla will have to sweat to attract customers for their Y and 3 Teslamobiles. Same with Lexus, Infiniti or Cadillac: they are decent cars but they have Zero likelihood to be selling large volumes because they always lack something or all the items of: proximity, tradition, commonality, local service. Same issues facing American car manufacturers in Japan or French car manufacturers in the US.

You can be very good but you still fail for some reason(s)... Just look at Norway, now.

With a handful of models Tesla will not dominate any maturing market. VW Group already has a broad range of models and look what a difference that makes: will its most successful model has only half the market share of Tesla's, its total market share is more than 4 times Tesla's. Similarly for other OEMs on a lower level.

DeleteAnd the big vendors are just starting their model roll out.

Does really anyone think, a company can make a major share of people drive all the same model in a given market segment?

The fact that Tesla does so well with a model that is in a somewhat niche (in Europe) segment, is testimony to Tesla's appeal.

DeleteOf course they will need more models to catch a major chunk of the market -- but it's only a matter of time for them to introduce more. They aren't rushing it though, since there is just no point when they still have trouble meeting demand for the existing models...

the first table heading states 'March'. This should be April, right?

ReplyDeleteYep, sorry about that.

DeleteWhy would the Mach E be internal competition to the Kuga PHEV? They are competing in completely different segments...

ReplyDeleteIf you worked at Ford or a Ford dealer, you might want to choose one of the two.

DeleteIs the Enyaq really that great? I haven't seen other opinions on it yet; but the takeaway from it's MEB-based cousins ID.3 and ID.4 thus far seems to be somewhat disappointing: while not bad vehicles by any means, they do not seem to be the game-changers we came to expect after years of hyping... Can the Enyaq on the same platform really break the pattern? Or is this just your personal preference for this form factor speaking?...

ReplyDeleteEnyaq has a more traditional design.

DeleteMaybe the majority likes that.

Audi Q4 E-tron could surprise.

It seems it has the best design between traditional and new.

The Enyaq is the "Skoda of EVs" :-D

DeleteAnd what does that mean? Yes, they aren't the most exciting vehicles around, but they are reliable, spacious and reasonably priced, which explains Skoda success in Europe and a few other markets, like China.

And considering the ID.3 and ID.4 aren't themselves all that exciting, i believe that on a pure rational logic, the Skoda is a better choice, for the reasons i explained on the text.

Now, would any of them be my choice? Probably not, on a personal level, and within the VW galaxy, i would rather go with the Cupra Born or the Q4 e-Tron Sportback, as they are less generic and show a little bit of personality

I wonder whether BMW is reluctant to give the i3 a larger battery, because it would put their newer (presumably more profitable) offerings in a bad light: including the Mini; and even the (much larger) iX3, that gets very mediocre range despite a decent-sized battery and a ridiculous price tag...

ReplyDeleteThe i3 will be discontinued this year according to a German EV magazine. It's an expensive car because of the carbon fiber and giving it a bigger battery would make it even less profitable. Now that they have the iX3 and two more EVs coming this year they don't need it any longer to achieve their emission targets. Also not sure why you think the iX3 range is mediocre. As far as I know it's better than the other premium SUVs like the EQC or e-Tron and even iPace even though they all have significantly bigger batteries. This would show in sales too if there was better availability of the iX3 and if they would offer the same lease deals as Audi does on the e-Tron which is insanely low.

DeleteSure, if they offer huge discounts (through leases or otherwise), it might become more competitive...

DeleteI seriously didn't expect the Model 3 to have a decent shot at another win in Europe, despite much more mainstream models from VW etc. entering the race...

ReplyDeleteJust be patient.

DeleteMustang Mach-e and BMW i4 will cut model 3 down enough.

Model Y will cut it down next year.

I would guess 3 + y = 1.2*3

Mach E is a different segment; as is Model Y. Historical data from Model X launch vs. Model S sales, and US Model Y launch vs. Model 3, suggests rather limited impact.

Deletei4 -- just like the other BMW BEVs built on combustion platforms -- will not be competitive.

There is nothing I can see that would significantly impact Model 3 sales for the rest of this year. Unless others *significantly* accelerate sales, the 2021 lead seems pretty robust...

Tesla Y has max payload 375 kg. The lowest of any CUV / SUV. That will not sell well in Europe.

Delete@Anonymus.

DeleteTesla payloads are kept very much as a secret. For sports cars like model 3 low payload may be acceptable.

But for model Y it is completely inacceptable.

Maybe that's why they are holding it back from Europe.

I hope they will improve Berlin version.

159.891 (15% share) is great. BEVs share @ 46% despite fewer models, combined with the leadership of ID4/ID3/Model 3 is proof that dedicated BEV are better than converted BEV.

ReplyDeleteSoon, MachE, Ioniq5 ... will give much needed boost to BEV and plugin segment overall.

YTD table March Europa Tesla model 3: 24.184

ReplyDeletehttp://ev-sales.blogspot.com/2021/04/europe-march-2021.html

YTD table April Europa Tesla model 3: 32.444

Where is the Tesla model 3 (8.260) in the April table?

24,184 were sales figures for the month of March, not YTD (those were 31,200).

DeleteOeps, my bad.

DeleteSo VW leads everyone already, not to mention VAG....

ReplyDeleteAs expected -- they are, after all, the most serious on EVs amongst legacy makers.

DeleteThe question is whether this is going to last, between Tesla introducing more mainstream models on one hand, and a slew of increasingly promising Chinese makers beginning international expansion on the other...

Exciting times in the electric vehicle industry! Ev Politics Project is paving the way for a sustainable future with their electric vehicle sales. Can't wait to witness the revolution on our roads and contribute to a cleaner, greener tomorrow.

ReplyDelete