Was? The Model 3 is eating our lunch? Counter-strike!

The European passenger plug-in market registered some 55,000 registrations in November (+44%), with the Dutch market and plugin hybrids (+80% YoY) to pull the market uo, while BEVs (+23%, lowest growth rate since June ‘18), are waiting for the 2020 flood, leading to an even (53% BEVs / 47% PHEVs vs 64% / 36% YTD) breakdown between both technologies, in November.

With plugin hybrids picking up speed, PEV’s climbed to 4.6% (2.4% for BEVs alone), pulling the 2019 PEV share to a record 3.3% (2.1% BEVs), above the 2.5% result of 2018.

With the two EV best sellers (Model 3 and Zoe) expected to have strong results in the last month of the year, PHEVs continuing to experience a surge and the Dutch market expected to have an Historic month in December, we should see the European market hit a new record next month.

The big news in November were the big results of several midsize cars, with the leader Tesla Model 3 (7,380 units in December, best off-peak performance for the Californian) working as the ignitor for legacy OEMs finally going all in in plugins, with the BMW 330e jumping to 5th in November, with 2,666 registrations, the model’s third record month in row(!). With the Bavarian suffering the biggest bleed from the Model 3, after all, it was the Bimmer that used to be known for the Ultimate Driving Machine, BMW is going all in for the 330e patch, in order to cut the bleeding, at least until the i4 antidote is not deployed, but even other brands, not so directly impacted by Tesla, like Mercedes and Volvo, are increasing their plugin efforts, with the S/V60 PHEV twins from Volvo reaching 828 registrations last month, while the Mercedes C300e/de twins have also hit 1,207 units, the best result for the three-pointed star midsize plugin since December 2016.

So, while the Model 3 isn’t creating enough gravitational force to become a black hole, like in the US, it’s strength is forcing the usual suspects to step up their game. Win, win, right?

Looking at the Monthly Models Ranking:

#1 Tesla Model 3– The poster child for electro mobility had its off-peak best month so far in Europe, with 7,380 deliveries, with the Model 3 benefiting from the Dutch EV year end rush and scoring 3,973 units in the Netherlands, but the UK, possibly the only European market not being starved by the Netherlands fever, also helped, as it had some 1,500 deliveries, while the remaining markets somewhat underperformed (452 units in Norway, 231 in Switzerland and 225 in France), affected by the fact that Tesla Netherlands was grabbing every available unit they could get their hands on. With the continuing of the backlog deployment in the UK, and record deliveries expected in the Netherlands, December could see another record month for the Tesla midsizer, even if most of the markets will be still suffering from starvation, which in turn will create (another) deliveries peak in Q1 2020. By the look of it, we should only know the organic demand of the Model 3 in Europe in second quarter of next year, or over a year after the landing of the sports sedan. Amazing, isn’t it?

#4 Nissan Leaf – With the 62 kWh version being delivered in volume, the Japanese model hit 2,722 units last month, which is a 42% drop. Worse still, this in the context of a fast growing market... Auch. Will the Nissan BEV be able to leave this downward spiral? Unless Nissan cuts prices significantly, and i am sure by now Nissan has more than enough margin to do it, the Leaf is looking irrelevant and outdated, especially next to a certain VW ID.3 …But back at November performances, the Japanese main markets were the Norway (535 units), the UK (500), The Netherlands (418), France (241) and Sweden (224).

#4 Nissan Leaf – With the 62 kWh version being delivered in volume, the Japanese model hit 2,722 units last month, which is a 42% drop. Worse still, this in the context of a fast growing market... Auch. Will the Nissan BEV be able to leave this downward spiral? Unless Nissan cuts prices significantly, and i am sure by now Nissan has more than enough margin to do it, the Leaf is looking irrelevant and outdated, especially next to a certain VW ID.3 …But back at November performances, the Japanese main markets were the Norway (535 units), the UK (500), The Netherlands (418), France (241) and Sweden (224). #5 BMW 330e – The original 330e was launched in Europe in 2015, basically as a compliance PHEV, with a symbolic 7.6 kWh battery, but despite it, it still managed to move some metal, sometimes reaching four-digit performances, like the record 1,566 units of March ’17, but things have moved on since, and the Model 3 started seriously denting on the Bimmer sales, so the German maker had a change of strategy for the 2nd generation of the plugin hybrid, if the specs continue...Meh, with just 12 kWh on the battery, half of what the BMW X5 PHEV has, the sales/production are really in another level, with the German midsizer scoring a new registrations record for the 3rd time in a row(!) in November, with 2,666 units, becoming last month Best Selling PHEV. How high will the 330e go, it is anyone’s guess (5,000 per month?), but i think in this case the limit will be first found on the demand side...Anyway, in November, their biggest markets were the UK (1,100 units), Germany (416) and Portugal (What tha...Yeah, i know), with 203 registrations.

#5 BMW 330e – The original 330e was launched in Europe in 2015, basically as a compliance PHEV, with a symbolic 7.6 kWh battery, but despite it, it still managed to move some metal, sometimes reaching four-digit performances, like the record 1,566 units of March ’17, but things have moved on since, and the Model 3 started seriously denting on the Bimmer sales, so the German maker had a change of strategy for the 2nd generation of the plugin hybrid, if the specs continue...Meh, with just 12 kWh on the battery, half of what the BMW X5 PHEV has, the sales/production are really in another level, with the German midsizer scoring a new registrations record for the 3rd time in a row(!) in November, with 2,666 units, becoming last month Best Selling PHEV. How high will the 330e go, it is anyone’s guess (5,000 per month?), but i think in this case the limit will be first found on the demand side...Anyway, in November, their biggest markets were the UK (1,100 units), Germany (416) and Portugal (What tha...Yeah, i know), with 203 registrations.

Looking at the 2019 ranking, if Tesla can already order the 2019 Best Seller party for the Model 3 and Renault can think about finding a place for the silver medal of the Zoe, the 3rd place of the Mitsubishi Outlander PHEV now seems certain too, as the #4 Nissan Leaf failed to impress in November, ans the distance (1,894 units) now seems insurmountable.

The Japanese hatchback now should worry itself with keeping the 4th spot from the hands wheels of the #5 BMW i3, only 411 units behind.

Below the front runners, the Mini Countryman PHEV scored its best result since March, with 1,691 registrations, allowing it to climb one position, to 8th, while the BMW 530e (1,580 units, best score since March) was also up, to #11, switching positions with its 225xe Active Tourer relative.

BMW had another good month, as the 330e was also on the up, joining the ranking, in #20

The Daimler Group had reasons to smile about, with the Smart Fortwo EV and the E300e/de twins climbed one position, with the tiny two seater going up to #15, while the luxury sedan went up to #16.

A mention to the #19 Tesla Model S, that registered 855 units, its best off-peak performance this year, while the Model X scored 697 units, also its best off-peak result this year.

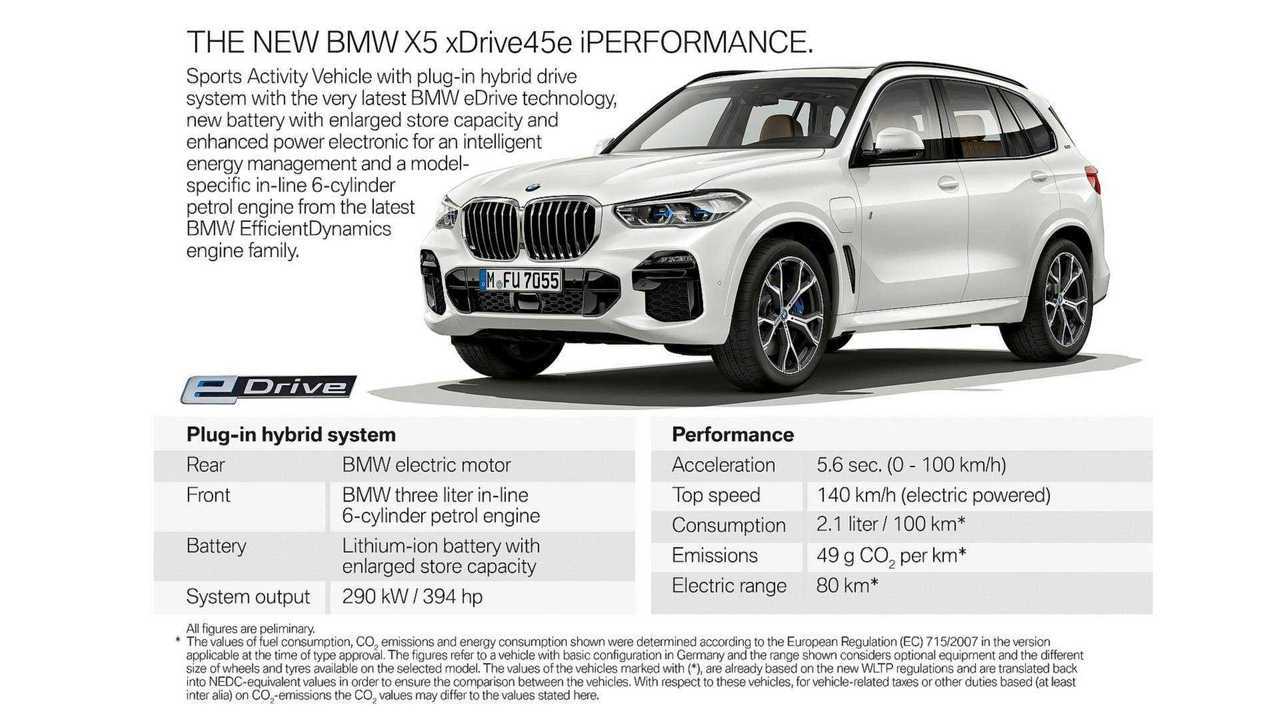

Outside the Top 20, besides the aforementioned good results from several European PHEVs, November brought two other brilliant results, like the popular VW Passat GTE scoring 1,875 units, the model best result of the last 3 years, while the new BMW X5 PHEV scored a record 1,068 units performance in only its second full month on the market, so it seems BMW’s long-range PHEV is set to become another success story for the Bavarian maker. Will we see it become the Best Selling Luxury plugin?

In the manufacturers ranking, Tesla (18%) is the leader, while last year winner BMW (14%) remains firm in the runner-up spot, ahead of Renault (9%), suffering from a short lineup, while Mitsubishi and Hyundai, stay outside the podium, both with 7% share.

Adding up numbers from individual countries in Western Europe (including the UK and Ireland), I get 7830 Model 3 sales for November rather than the 7380 in your post. Did you interchange a couple of digits in the total? Anyway, if November was good, December should be epic!

ReplyDeleteSorry, but reviewing my numbers, i just don't see how the Model 3 would reach 7830 units. I'll stick with my guns (7.380).

DeleteNetherlands November:

ReplyDeleteLeaf 62kWh: 221

Leaf 40kWh: 198

The deliveries of the 62kWh version started to gain volume in the second half of November.

December until 2019-12-22

Leaf 62kWh: 311

Leaf 40kWh: 124

A bit nearsighted, with a lot of attention on my home country.

So previous months were still mostly the 40 kWh variant? Meaning we might yet see a little bump from the 62 kWh one?...

DeleteCould be, but Nissan needs to drop prices of both versions, especially the 62 kWh version, and it's not even because of Tesla.

DeleteThe Kia Niro EV has a better price/specs ratio right now, and the Peugeot 2008 EV and VW ID.3 are coming...

Yeah, I totally agree that the 62 kWh variant especially is not really competitive any more at the current price... Have been saying that all along, even before it came out. (While most others expected it to sell much better than the 40 kWh one, despite that one actually being more competitive at its price...)

DeleteThe Leaf should be made "special" again, with ProPilot standard on all trim levels and models.

DeleteLower the price by ~10% and the Leaf has a golden future.

Lowering the price by 10% could surely move the needle on sales quite a bit -- but it would likely also about halve the gross margin... Can Nissan really afford that?

DeleteTo be honest, I have major doubts the Leaf can become a leader again without a new platform...

Nissan dropped prices of the 30 kWh version at a given time and sales went way up.

DeleteAs if Nissan has margin, it has, the platform is more than paid for, batteries are on the cheap side, so i guess Nissan has a larger margin to cut prices than most of the competition.

So only Kia is really down compared to YTD average... Does that mean that other makers haven't actually been delaying deliveries to next year -- or just not quite as much?...

ReplyDeleteMaybe not quite as much. Kia has been caught saying to their dealers to hold orders until 2020, something that others didn't.

DeleteAnd do not forget the Kia Soul EV thing (Registering in Germany, then sending them to Norway) a couple of years back, Kia already went that extra mile in the past to play with the rules, so it is not surprising they are doing the same now.

Good point... There is indeed a pattern there!

Delete"Others" row is growing every month.Need top30 in 2020 reviews.

ReplyDeleteLeaf recently fell in price in the UK.Probably,cheaper soon in other markets

ReplyDeleteAnd here I believed them they didn't want to do the discount game any more... ;-)

DeleteMakes sense though: at the current prices, it's just not that special any more.

True. And they have more than enough margin to lower the price by now...

DeleteNissan sold for one day 299 Leaf in the Netherlands.The price down,probably.

DeleteMore likely they finally woke up to the year-end demand spike from the subsidy cut?...

DeleteLeaf well sells in Norway 02.01.2020.Nissan lowered the price, no doubt.This is just the beginning.Who will be next?Tesla 3,I-Pace,Ioniq,Soul,Zoe

DeleteThe beginning of the month is simply disastrous in the Netherlands for BEVs.Too bad.

DeleteTotally expected. Only people who literally decided to buy a car in the last couple of days would buy a BEV now, instead of before the subsidy cut at end of last year...

DeleteRenault Zoe (#2) + Mits Outlander (#3) combined YTD sales is

ReplyDelete42.708 + 32.211 and that adds upto 74.919 which is 1.878 ahead of Tesla Model-3.

I guess in Dec sales, Model-3 will be ahead of #2 + #3.

Once the GF-3 starts production for Chinese market, Fremont, CA, USA can cater to the needs of just US + EU resulting in higher deliveries for Europe starting from 2020-01.

I believe VW ID.3 will start the sales only in 2020-Summer and no one knows whether they will sell actively. Still the Europeans will start selling at least PHEVs actively to counter Tesla.

Hoping for the leadership change in Nissan will help sell Leaf more.

The Shanghai factory will only produce the SR+ Model 3 (at least initially); and orders for the made-in-China one have been open for months -- in fact they stopped taking orders for Fremont-made SR+ a while back. In other words, all exports to China right now are models that they will keep exporting -- i.e. it shouldn't affect Fremont capacity in a meaningful way.

DeleteI don't think this is a problem, though: while currently they can't keep up with European orders, that's mostly due to the subsidy-related anomaly in the Netherlands, which will reverse after year end. To a smaller degree that's also happening in the US, with the last of the federal subsidies expiring for Tesla at year end. Along with the general order weakness in Q1 in all markets, I think Tesla should be able to fill all backlog in Q1, and have enough capacity for new orders going forward.

Regarding ID.3, VW is *already* trying to sell it actively -- and I doubt that will change when deliveries finally start...

As for the Leaf... I don't have much hope there. It appears that Nissan belatedly decided to follow Tesla's original approach, focusing on premium vehicles -- at a time when Tesla (and VW) are already past that, and pushing for the mainstream...

(Still better though than some makers now trying to enter with tiny, overpriced, short-range "city" EVs -- i.e. they haven't even learned the lesson from Nissan's and others' early failure yet...)

There are a handful of key facts that are shapping current EV industry:

ReplyDelete- no one is capable yet of bringing up a profitable dedicated platform on every 5 or 7 year model cycle (Leaf:12 years, Model S:11 years, Zoe:10 years, i3:10 years);

- dedicated EV manufacturers aren't able to generate self-funding profits, instead they are relying on borrowed money (StreetScooter GmbH, Tesla Motors);

- EVs are just starting to face now, head-on at a leveled ground, competing PHEVs and mHEVs

written by Looney Tunes

Your numbers seem speculation at best, given that we don't know when most of these models will get a new platform (or get dropped altogether)... The Tesla number at least seems completely baseless. What gives you the idea they intend to replace the platform in 2023? Sounds like the closest thing to a new platform will come with the Plaid power train next year -- that's 8 years for the original platform, not 11. Plus, in Tesla's case at least, it's simply a matter of engineering resources, not profitability...

DeleteAs for "self-funding profits": car manufacturing has always been very capital-expensive -- contrary to the narrative pushed by naysayers, nobody really *expects* them to be self-funding while having >40% CAGR... Despite Elon's proclamations, pretty much all the major analysts expect Tesla to raise further funds in the future -- *especially* the bullish ones, who assume rapid growth will continue.

From what i can read from Tesla smoke signals, i guess once the Model Y, Roadster, Semi and Cybertruck are out, Tesla will focus on profitability and milking what they have, so i would not expect new models getting into production at least until late 2023 or 2024, even.

DeleteThe priority will be of course the Model S, followed by the Model X, some 6 to 12 months after.

Only after that, we should see new generations for the Model 3/Y and possibly after those two, a Model C compact vehicle, that would compete with the 2nd Generation VW ID.3, to be launched sometime in the same timeline.

I don't think Tesla will go into "milking" mode any time soon, as long as Elon is in charge -- not before the EV transition is mostly done (at some point in the second part of the next decade), and thus there are no low-hanging fruit left for growing EV sales...

DeleteI think the reason why Tesla doesn't talk much about further models beyond those already announced, is that autonomy is sort of like a singularity: it's very hard to predict what kinds of vehicles will be in demand once autonomy becomes widely available...

It's 1st January and several countries have stockpile Model 3 available. The Netherlands bubble has not caused any shortages for other countries.

ReplyDeleteYep, the first signs are confirming that.

DeleteThat's not exactly true: there were multiple reports of February being shown as delivery estimate for new orders of various models in other European countries.

DeleteOf course it's entirely likely that Tesla was reserving some extra for Netherlands just in case, and released this extra allocation when they got a clearer picture on actual last-minute demand in the Netherlands -- but since at least some of that surely happened only on very short notice, it still almost certainly means December deliveries in many countries were supply-constrained, and we will see extra deliveries in Q1 instead...

The whole question is price.There is a lot of competition for manufactures is a resourse to reduce it.The first sings are already appearing:e-Golf,Nissan Leaf.This is a trend that cannot be stopped.

DeleteNo doubt rhat all manufacturers will reduce the price after the first quaarter.

DeleteDoes it seem like a bubble in the Netherlands?People are willing to treat themselves and nature well.Need to give them this opportunity.

DeleteNetherlands:23000 BEVs,market share 55%

DeleteThe price of the battery is very much reduced.Expected prised to go down on BEVs

DeleteA consumer in EU is ready to buy BEV the whole question is the price.

ReplyDeleteStart of sales in Norway Citigo and Ds3

ReplyDelete